While elections are important to any functioning democracy, to investment professionals, elections are primarily significant due to their effect on portfolios. In particular, investors must understand – and anticipate – the correlation between the outcomes of the election and the markets, if any.

Red, Blue or Purple – Does It Matter Who Wins?

It is true that politics can be deeply personal, especially because the issues addressed by both parties extend well beyond capital markets. Additionally, elected officials can enact policies that, for the long term, may impact markets and market returns. However, despite these facts, it seems investors place far too much onus on market returns and their connections with presidential election results.

First, consider the presidency in terms of the markets and the importance of the executive branch. While it is the highest office in the land, the president is not a solo act. The U.S. and global economies act outside of the U.S. president’s control, and the president by design is often forced to work with the legislative branch to enact substantive polices that may have long-term economic impact.

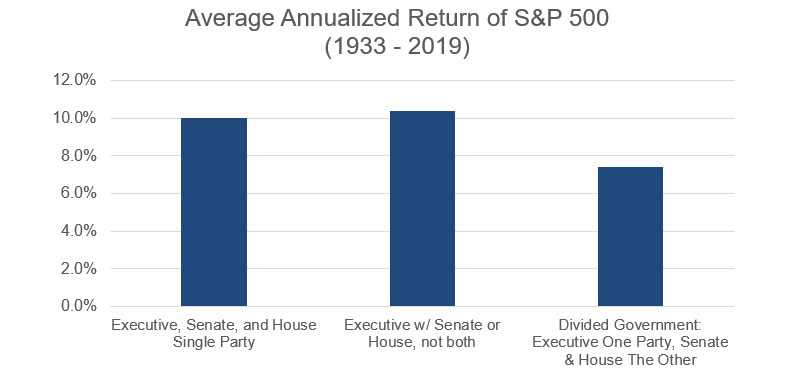

Therefore, keeping this in mind, simply looking at political party based on presidency is too narrow as a frame of reference. Below are historical outcomes and party control noting that markets tend to persevere regardless of party.

So Why Do Markets Seemingly React During Election Season?

With the above data to support the hypothesis that the markets are resilient to which party takes power, succeeding regardless of the party that is in control, why does it feel like such a critical event to investors every four years during the presidential election?

In short, investors are predisposed to feel like it is. During presidential election years, market volatility tends to increase in the months leading up to the election date. This volatility is not based on definitive evidence affirming that one party is better than the other for market returns. Rather, this heightened volatility is based more on uncertainty.

With investing, just like many other things in life, individuals do not like uncertainty. In actuality, markets often even tend to dislike uncertainty more than they dislike bad news. With bad news, investors can analyze the results and move forward. Uncertainty, in contrast, can leave investors paralyzed or even selling first and asking questions later. While it can be explained, this phenomenon does not require the attention and immediate reaction of investors. Harnessing the knowledge of greater market volatility in an election year is not only helpful to avoid classic behavioral mistakes that can lead to worse portfolio outcomes, but it also reinforces the notion that investors are more likely to be successful if they maintain a long-term point of view.

Conclusion

Uncertainty is uncomfortable. Investors deal with uncertainty every day as there is no guarantee of future outcomes. Elections are another cog in the wheel of uncertainty that adds to uneasiness regarding investor portfolios and the market. However, with an extensive knowledge and understanding that heightened volatility will be likely during such times, procedures exist to resolve any disputes arising from these tumultuous times and markets are not disproportionally benefited by the victory of one party or the other, therefore we advocate patience. Maintaining a thoughtfully designed and disciplined investment strategy meant to weather changing political regimes, economic conditions and a myriad of other adverse situations that result from these elections is, in our opinion, the best way to succeed over the long term.