Should you save for a child’s education in your name or theirs?

There are three potential drawbacks to saving money for a child’s education under his or her own name: the kiddie tax, federal financial aid rules, and control issues. First, the kiddie tax. At one time, saving money for college in a child’s name was recommended because of the tax saving opportunities that resulted when children […]

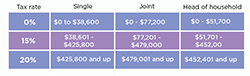

Understanding capital gains in light of new tax laws

The U.S. stock market this year has given total returns so far of close to 10 percent, which is a good thing for investors. But with the exception of savings in retirement accounts such as 401(k)s and individual retirement accounts (IRAs), Uncle Sam will probably take a cut of your newfound wealth in capital gains tax. […]