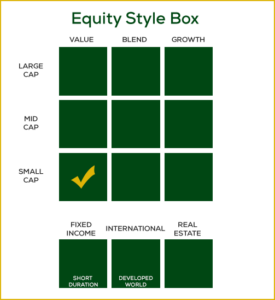

Small Cap Value Portfolio

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

Why Small Cap Value Stocks?

Small cap value stocks offer significant investment potential due to their unique characteristics. These stocks, representing smaller companies considered undervalued based on financial metrics, have historically delivered higher returns compared to large cap and growth stocks. The growth potential in small cap companies is substantial as they can expand rapidly from their smaller base. Moreover, they are often overlooked by analysts and institutional investors, leading to market inefficiencies that can be exploited by diligent investors.

Small cap value stocks offer significant investment potential due to their unique characteristics. These stocks, representing smaller companies considered undervalued based on financial metrics, have historically delivered higher returns compared to large cap and growth stocks. The growth potential in small cap companies is substantial as they can expand rapidly from their smaller base. Moreover, they are often overlooked by analysts and institutional investors, leading to market inefficiencies that can be exploited by diligent investors.

Small cap value stocks tend to diversify a portfolio, as they often operate in different sectors and exhibit lower correlation with large cap stocks. This can provide a hedge during market downturns. Their cyclical nature also means they can offer strong rebounds during economic recoveries.

Tributary Capital Management’s parent company has a rich history dating back to the mid-1800s. They are a wholly owned subsidiary of First National Bank of Omaha, which is a wholly owned subsidiary of First National of Nebraska, the largest privately held financial services company in the United States.

They are an investment adviser registered with the Securities and Exchange Commission. The firm manages assets for corporations, mutual funds and other institutions. The firm’s investment team averages nearly eighteen years of industry experience, including over eight years with Tributary. Five of their investment professionals hold the CFA® charter.

Quick Links

More Information

Meet the Managers

Mark Wynegar, CFA® is the lead portfolio manager for the small cap value strategy. He has over 18 years of investment management experience and joined Tributary’s predecessor, First Investment Group, in 1999. Prior to joining Tributary, he worked at Westchester Capital Management as a Senior Securities Analyst. Mark earned his Bachelor of Science in Business Administration from the University of Nebraska in 1993. He is a member of the CFA® Society of Nebraska and the CFA® Institute. He served on the Board of the CFA® Society of Nebraska from 2002-09 and was president of the society from 2007-08.

Mark Wynegar, CFA® is the lead portfolio manager for the small cap value strategy. He has over 18 years of investment management experience and joined Tributary’s predecessor, First Investment Group, in 1999. Prior to joining Tributary, he worked at Westchester Capital Management as a Senior Securities Analyst. Mark earned his Bachelor of Science in Business Administration from the University of Nebraska in 1993. He is a member of the CFA® Society of Nebraska and the CFA® Institute. He served on the Board of the CFA® Society of Nebraska from 2002-09 and was president of the society from 2007-08.

Mike Johnson, CFA® serves as a portfolio manager for the small cap value strategy. He has over 20 years of investment management experience and joined Tributary’s predecessor, First Investment Group in 2005. Prior to joining Tributary, he worked as an equity analyst and portfolio manager at Principal Global Investors. Mike earned his Bachelor of Science degree in Business Administration from the University of Nebraska in 1992 and MBA from Drake University. He is a Chartered Financial Analyst and a member of the CFA® Society of Nebraska and the CFA® Institute.

Mike Johnson, CFA® serves as a portfolio manager for the small cap value strategy. He has over 20 years of investment management experience and joined Tributary’s predecessor, First Investment Group in 2005. Prior to joining Tributary, he worked as an equity analyst and portfolio manager at Principal Global Investors. Mike earned his Bachelor of Science degree in Business Administration from the University of Nebraska in 1992 and MBA from Drake University. He is a Chartered Financial Analyst and a member of the CFA® Society of Nebraska and the CFA® Institute.

Investment Approach

Tributary manages Azzad’s small cap value model using an investment process driven primarily by qualitative analysis. Investments are chosen from a universe of securities passing Azzad’s ethical screens. The managers identify stocks that have been mispriced by the market and purchase or sell those investments to take advantage of eventual re-pricing. By owning quality companies in such situations, the strategy attempts to generate above-average returns with below-average risk. The strategy seeks to ensure downside protection through strong financial position and valuation analysis, while identifying upside catalysts with management interviews, company visits, and competitive position/industry analysis.

Small cap investing involves risks including loss of principal. CFA is a trademark owned by CFA Institute.