Purification Calculator

About Purification

Calculator

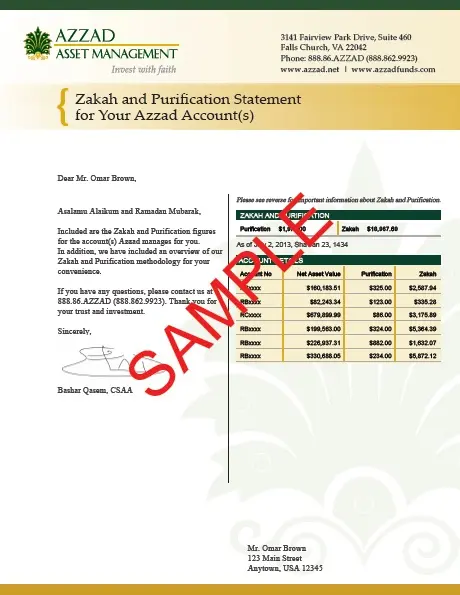

To assist clients in determining these amounts so that they may take steps to cleanse their accounts of such money, we provide purification totals on a per share basis. Purification amounts are provided using the calculator below. To ensure correct calculation, please select dates from the drop-down calendar.

Unintended Income

Many publicly held companies derive a small portion of earnings from impermissible sources.

This could be income an otherwise permissible investment like a technology firm has earned in an interest-bearing bank account. Or a secondary business activity like alcohol or adult entertainment offered by airlines or the hospitality industry.

Shareholders should not intend to benefit from this income. Rather, they are advised to give it away in order to offset any harm stemming from the impermissible business activity.

As such, purification totals are calculated for the companies held by the Azzad Funds.

Note: Purification is a cleansing process that accounts for the income of investments that may be generated from unlawful activities according to the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

How we Calculate Purification

Azzad calculates purification and accrues it daily, using the following inputs*:

1. Number of each security’s shares

2. Net income per share for each security

3. Number of days held for each security

Azzad provides only purification calculation figures. It is the shareholder’s responsibility to disburse the amount of purification to their preferred charities or recipients.

A Note On Our Process

Purification calculation figures are conservative estimates (khars, in Arabic) and may not be the exact amounts of income earned from business activities deemed to be inconsistent with Azzad’s Ethical & Shari’ah Guidelines.

Azzad shall not be liable for the inaccuracy of such amounts. Purification is not required to be paid from the exact account on which purification is assessed. It may be paid in kind from any money shareholders have in checking and/or savings accounts.

Clients bear all liability for any taxes and/or penalties that may be incurred when money is withdrawn from an account.

Azzad Asset Management does not provide tax advice.

Shareholders should consult with a tax advisor to discuss any tax consequences that may result from liquidating or distributing an account.