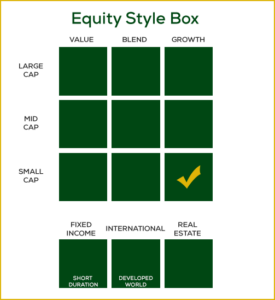

Small Cap Growth Portfolio

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

Why Small Cap Growth Stocks?

Small cap growth stocks are appealing due to their potential for substantial capital appreciation. These stocks represent smaller companies that are expected to grow at an above-average rate compared to other firms. Their smaller size allows them to expand rapidly, often leading to significant increases in stock value. Historically, small cap growth stocks have delivered strong performance, driven by their capacity for innovation and market penetration.

Small cap growth stocks are appealing due to their potential for substantial capital appreciation. These stocks represent smaller companies that are expected to grow at an above-average rate compared to other firms. Their smaller size allows them to expand rapidly, often leading to significant increases in stock value. Historically, small cap growth stocks have delivered strong performance, driven by their capacity for innovation and market penetration.

Investing in small cap growth stocks can provide diversification benefits. These companies often operate in emerging or niche markets, offering exposure to sectors not dominated by large cap stocks. This diversification can enhance a portfolio’s overall growth potential and reduce reliance on traditional large cap stocks.

Kayne Anderson Rudnick Investment Management (KAR) was founded in 1984 by two successful entrepreneurs, Richard Kayne and John Anderson, to manage the funds of its principals and clients. John Anderson was a prominent Los Angeles attorney and businessman, member of the Forbes 400 and named benefactor of The Anderson School of Business at The University of California, Los Angeles.

Clients include corporate and public pension plans, foundations, endowments, brokerage firms, and high-net-worth individuals. Our range of domestic equity and fixed income strategies all embody our unified investment philosophy. The firm, headquartered in Los Angeles, is wholly owned by Virtus Investment Partners (NASDAQ: VRTS).

Quick Links

More Information

Meet the Managers

Todd Beiley, CFA® is a portfolio manager and a senior research analyst with primary research responsibilities for the small and mid-capitalization financials and producer-durables sectors. Before joining Kayne Anderson Rudnick in 2002, he worked as an Associate Analyst in equity research at Prudential Securities and before that was an Equity Research Associate at RNC Capital Management. He has 18 years of equity research experience. Mr. Beiley earned a Bachelor of Science degree in finance from Northern Arizona University and an MBA. from the University of Southern California. Mr. Beiley is a Chartered Financial Analyst charterholder.

Todd Beiley, CFA® is a portfolio manager and a senior research analyst with primary research responsibilities for the small and mid-capitalization financials and producer-durables sectors. Before joining Kayne Anderson Rudnick in 2002, he worked as an Associate Analyst in equity research at Prudential Securities and before that was an Equity Research Associate at RNC Capital Management. He has 18 years of equity research experience. Mr. Beiley earned a Bachelor of Science degree in finance from Northern Arizona University and an MBA. from the University of Southern California. Mr. Beiley is a Chartered Financial Analyst charterholder.

Jon Christensen, CFA® is a portfolio manager and a senior research analyst with primary research responsibilities for the small and mid-capitalization health-care sector. Before joining Kayne Anderson Rudnick in 2001, Mr. Christensen was a portfolio manager and senior research analyst for Doheny Asset Management and has approximately 22 years of equity research experience. He earned a Bachelor of Science degree in mathematics/applied science from the University of California, Los Angeles, and an M.B.A. from the California State University, Long Beach. Mr. Christensen is a Chartered Financial Analyst charterholder.

Jon Christensen, CFA® is a portfolio manager and a senior research analyst with primary research responsibilities for the small and mid-capitalization health-care sector. Before joining Kayne Anderson Rudnick in 2001, Mr. Christensen was a portfolio manager and senior research analyst for Doheny Asset Management and has approximately 22 years of equity research experience. He earned a Bachelor of Science degree in mathematics/applied science from the University of California, Los Angeles, and an M.B.A. from the California State University, Long Beach. Mr. Christensen is a Chartered Financial Analyst charterholder.

Investment Approach

The KAR Small Cap Sustainable Growth strategy follows a growth investment style, investing primarily in small cap growth companies that are expected to deliver long-term, risk-adjusted performance. Historically, small cap stocks have outperformed large and mid cap stocks because of their greater potential for growth, but with greater volatility. The portfolio typically varies to within 10% of the sector weights of the Russell 2000 Growth Index and is relatively concentrated with 25 to 35 securities.

The Kayne Anderson Rudnick investment philosophy is that strong risk-adjusted returns can be achieved through investment in high-quality companies purchased at reasonable prices. The firm uses a disciplined, bottom-up, fundamental research approach to identify companies with rising free cash flow, high reinvestment rate, and strong financial characteristics.

Small cap investing involves risks including loss of principal. CFA is a trademark owned by CFA Institute.