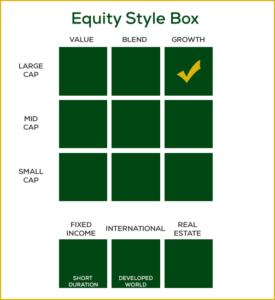

Large Cap Growth Portfolio

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

Why Large Cap Growth Stocks?

Large cap growth stocks are attractive for their potential to offer substantial capital appreciation while maintaining relative stability. These stocks represent well-established companies with market capitalizations typically over $10 billion, known for their strong growth prospects. They often operate in dynamic sectors such as technology, healthcare, and consumer goods, where innovation and market leadership drive revenue and earnings growth.

Large cap growth stocks are attractive for their potential to offer substantial capital appreciation while maintaining relative stability. These stocks represent well-established companies with market capitalizations typically over $10 billion, known for their strong growth prospects. They often operate in dynamic sectors such as technology, healthcare, and consumer goods, where innovation and market leadership drive revenue and earnings growth.

Investing in large cap growth stocks provides the dual benefits of growth potential and reduced risk compared to smaller cap stocks. These companies have proven business models, robust financial health, and the resources to invest in research, development, and expansion. Their established market presence reduces the risk of failure, making them a safer choice for growth-oriented investors.

F/m Investments is a multi-boutique investment firm providing diversified investment strategies to advisors and institutional investors across asset classes, markets, and styles. They believe that putting long-tenured, experienced investment teams in an environment that encourages collabortion is critical to producing results for clients.

Quick Links

More Information

Meet the Manager

Christian J. Greiner, CFA®, has been an active partner with the Azzad portfolio management team for over 10 years.

Christian J. Greiner, CFA®, has been an active partner with the Azzad portfolio management team for over 10 years.

Christian joined Ziegler (now F/m Investments) in 2003 as an Equity Analyst. Currently, he is a Portfolio Manager who provides fundamental research across all sectors and participates in the decision making process for stock selection.

He has a substantial role in the quantitative research effort, contributing to the stock scoring model research. He has been responsible for developing a system that aggregates investment community sentiment towards individual stocks, and in the past has worked on quantitative tax-effective investment strategies, as well as long-short and other specialized strategies for the firm.

Christian holds a B.S. in Finance from DePaul University, as well as an M.B.A from the University of Chicago. Christian earned the Chartered Financial Analyst (CFA®) designation, and is a member of the CFA® Society of Chicago.

Prior to joining the firm, he held positions with Checkfree Investment Services and Northern Trust.

Investment Approach

Ziegler Capital Management, LLC is a registered investment adviser based in Chicago and provides investment solutions for institutions, mutual funds, municipalities, pension plans, Taft Hartley plans, and individual investors.

Ziegler’s collaborative team manages the large-cap growth model. Investments are chosen from a universe of stocks passing Azzad’s ethical screens. Ziegler evaluates companies by combining a proprietary quantitative model that scores stocks with a fundamental evaluation that confirms the attractiveness of the top scoring stocks.

This multi-factor model uses cash flow analysis to identify stocks that are trading at or below their fair market value. The process is based on a belief that inflation adjusted returns and cash flow analysis provide the most accurate measure of a company’s value.

The essence of the investment strategy is to invest in quality companies that share several attributes that the portfolio managers believe should result in capital appreciation over time: sustainable competitive advantages, promising fundamentals that allow for significant earnings growth, skilled management teams and solid financials including low debt.