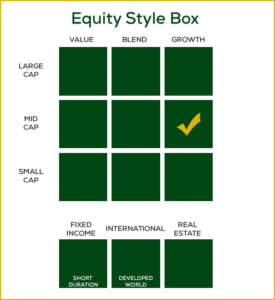

Mid Cap Growth Portfolio

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

Why Mid Cap Growth Stocks?

Mid cap growth stocks are attractive for their balance of growth potential and relative stability. Representing companies with market capitalizations typically between $2 billion and $10 billion, these stocks offer substantial growth opportunities. They are often well-established enough to mitigate some of the risks associated with small cap stocks but still possess significant room for expansion and innovation.

Mid cap growth stocks are attractive for their balance of growth potential and relative stability. Representing companies with market capitalizations typically between $2 billion and $10 billion, these stocks offer substantial growth opportunities. They are often well-established enough to mitigate some of the risks associated with small cap stocks but still possess significant room for expansion and innovation.

Investing in mid cap growth stocks can provide a sweet spot in a diversified portfolio. These companies have generally moved beyond the volatile early stages of development, offering more stability than small cap stocks. At the same time, they can grow faster than large cap stocks, which are often more mature and have less room for rapid expansion.

D.F. Dent was founded as an independent investment counseling firm by Daniel F. Dent in 1976. The firm is wholly owned by its nine principals and is unaffiliated with any other financial organization.

D.F. Dent provides portfolio management services to individuals, high net worth individuals, corporate pension and profit‐sharing plans, Taft‐Hartley plans, wrap‐fee programs/UMAs, charitable institutions, foundations, endowments, municipalities, registered mutual funds, private investment funds, trust programs, and other U.S. institutions.

Meet the Managers

Thomas F. O’Neil, Jr., CFA®, joined D.F. Dent and Company in the summer of 1985 with 15 years of experience in the field of investment management. For the previous 6 years, he served in the position of financial adviser to a Maryland family with philanthropic interests where his responsibilities included management of the family’s investments. Prior to that position, for nine years he was responsible for the investment of insurance companies’ funds in the equity and fixed-income markets for a large Maryland based corporation called Commercial Credit Corp. Mr. O’Neil is a graduate of Georgetown University, Columbia University Graduate School of Business where he received an MBA in finance and banking. He is also a CFA Charterholder. He has served on the boards of various non-profit organizations. Mr. O’Neil is a Vice President at D.F. Dent and Company and serves as a portfolio manager and analyst.

Thomas F. O’Neil, Jr., CFA®, joined D.F. Dent and Company in the summer of 1985 with 15 years of experience in the field of investment management. For the previous 6 years, he served in the position of financial adviser to a Maryland family with philanthropic interests where his responsibilities included management of the family’s investments. Prior to that position, for nine years he was responsible for the investment of insurance companies’ funds in the equity and fixed-income markets for a large Maryland based corporation called Commercial Credit Corp. Mr. O’Neil is a graduate of Georgetown University, Columbia University Graduate School of Business where he received an MBA in finance and banking. He is also a CFA Charterholder. He has served on the boards of various non-profit organizations. Mr. O’Neil is a Vice President at D.F. Dent and Company and serves as a portfolio manager and analyst.

Matthew F. Dent, CFA®, joined D.F. Dent and Company in the summer of 2001 with four years of investment experience. Prior to joining D.F. Dent and Company, Mr. Dent served as a research associate at Stafford Capital in San Francisco, a research associate at Robertson Stephens in San Francisco, and as an investment banking analyst at DB Alex Brown in Baltimore. Mr. Dent is a graduate of Brown University, where he received a B.A. in both Economics and Organizational Behavior and Management. Mr. Dent is a CFA® Charterholder and is currently a member of the CFA Institute and the Baltimore Security Analysts Society. He serves on the board of a local non-profit organization and is an active member of the Young Presidents Organization (YPO). Mr. Dent is President of D.F. Dent and Company and serves as a portfolio manager and analyst.

Gary D. Mitchell, J.D. joined D.F. Dent and Company in the summer of 2005 with 13 years of experience practicing law. Prior to joining D.F. Dent and Company, Mr. Mitchell was a corporate attorney for C.R. Bard and Lucent Technologies, two S&P 500 companies in New Jersey. Prior to his corporate experience, Mr. Mitchell was an attorney in the New York office of Sidley & Austin. His experience includes corporate, securities and regulatory law, as well as mergers and acquisitions and corporate governance. Mr. Mitchell received an A.B. from Harvard College summa cum laude in Economics and received a J.D. from Harvard Law School cum laude. Mr. Mitchell is a Vice President of D.F. Dent and Company and serves as a portfolio manager, analyst and Chief Compliance Officer.

Gary D. Mitchell, J.D. joined D.F. Dent and Company in the summer of 2005 with 13 years of experience practicing law. Prior to joining D.F. Dent and Company, Mr. Mitchell was a corporate attorney for C.R. Bard and Lucent Technologies, two S&P 500 companies in New Jersey. Prior to his corporate experience, Mr. Mitchell was an attorney in the New York office of Sidley & Austin. His experience includes corporate, securities and regulatory law, as well as mergers and acquisitions and corporate governance. Mr. Mitchell received an A.B. from Harvard College summa cum laude in Economics and received a J.D. from Harvard Law School cum laude. Mr. Mitchell is a Vice President of D.F. Dent and Company and serves as a portfolio manager, analyst and Chief Compliance Officer.

Bruce L. Kennedy, II, CFA®, joined D.F. Dent and Company in the summer of 2007 with four years of investment experience. Prior to joining D.F. Dent and Company, he served as a summer analyst at Wasatch Advisors in Salt Lake City, an associate analyst at T. Rowe Price in Baltimore, and an investment banking analyst at Goldman, Sachs & Co. in New York. Mr. Kennedy received an A.B. from Dartmouth College cum laude in Economics and History and an MBA from Stanford Graduate School of Business. Mr. Kennedy is a Vice President of D.F. Dent and Company and a CFA® Charterholder. Mr. Kennedy currently serves as a portfolio manager, analyst and Director of Research.

Investment Approach

D.F. Dent and Company is a quality growth investor that manages concentrated, low-turnover portfolios consisting of high conviction investment ideas. We look for: best-in-class companies that dominate a niche market, talented and ethical management teams, and advantaged business models with a wide moat and superior returns on capital.

D.F. Dent and Company invests in companies that we expect to grow and appreciate at levels faster than the overall economy and stock market. We look for management teams that are highly ethical and are exceptional leaders. Our portfolio companies have successful business models and are competitively differentiated. Investment success is attained by building a concentrated portfolio of companies that have attractive long-term opportunities and that operate in favorable industry sectors.