Although the stocks of large companies like Amazon and Alphabet have been among the market leaders since last year, in recent months they’ve started to lose some of their luster. In their place, small company stocks have assumed the top spot for outsized performance.

Although the stocks of large companies like Amazon and Alphabet have been among the market leaders since last year, in recent months they’ve started to lose some of their luster. In their place, small company stocks have assumed the top spot for outsized performance.

The reasons some of the market’s biggest returns have come from some of its smallest companies include the recently passed tax overhaul and stronger earnings. Those tailwinds, along with an out-of-the-box stock-picking strategy, have helped Azzad’s small cap-growth portfolio manager Kayne Anderson Rudnick (KAR) stand out over the last quarter.

“Our goal is to achieve excellent long-term investment results by owning a handful of businesses with enduring competitive protections purchased at attractive prices,” says KAR portfolio manager Todd Beiley, CFA, in a recent client note. “We employ thorough research in an attempt to understand the advantages and vulnerabilities of a business. We do not attempt to predict movements in the stock market or the economy, but instead we seek to understand companies and their worth so that we are in a position to recognize attractive prices when they arise.”

Beiley and colleague Jon Christensen, CFA, co-manage Azzad’s small-cap growth portfolio, which has been a standout performer among the 10 investment portfolios managed by Azzad’s institutional team. KAR believes that its approach to seeking risk-adjusted returns is part of the reason for that.

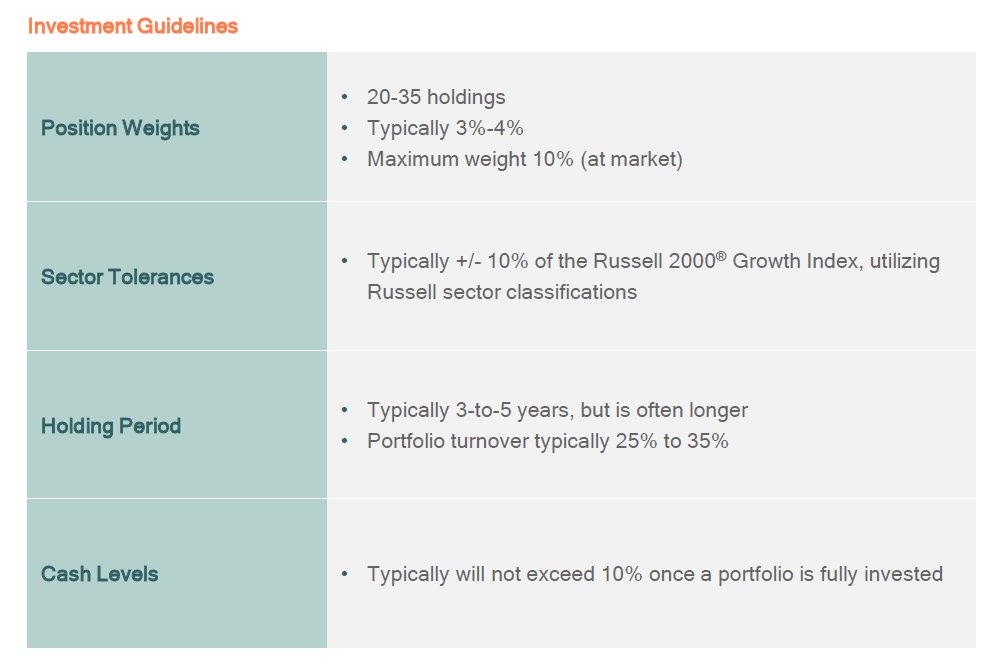

KAR runs a more concentrated stock portfolio than the typical manager, opting to take larger stakes in what qualify as high-quality companies according to their methodology. The small-cap growth strategy usually holds 20-35 stocks compared to the classic approach of holding up to 75 names. In addition, because of their high-conviction/high-confidence research, KAR will often hold a company longer than the norm–36 to 60 months on average versus 6 months for a more conventional approach.

Because they recognize that they’re managing the portfolio as the small-cap growth component of a larger asset allocation program, KAR stays in their lane and focuses on the stocks of smaller-sized companies with competitive advantages at attractive valuations. They know that Azzad’s small-cap growth portfolio is just one spoke in a wheel. But it’s been a real standout of late, achieving a return meaningfully above that of the Russell 2000® Growth Index, the portfolio’s benchmark.

All of this translates into an investment strategy in the Azzad Ethical Wrap Program that has pulled more than its weight in recent months. And it’s why Kayne Anderson Rudnick is this month’s featured portfolio manager.

Past performance cannot guarantee future results.