Why for-profit immigration detention facilities need to be excluded from socially responsible portfolios

If you’re anything like me, you’ve watched with heartbreak the countless images flooding the news these days of asylum seekers in cages and children separated from their parents. You may have also wondered what you can do, short of heading to the border to volunteer for a legal aid organization.

If you have money invested in the stock market — perhaps in a retirement account — one thing you can do is make sure your dollars aren’t supporting the for-profit prisons that hold detained immigrants.

About 70 percent of immigrant detainees are held in facilities owned by for-profit companies, according to the National Immigrant Justice Center.

The two largest for-profit prison contractors in the United States are GEO Group and CoreCivic. They’re also the only ones that are publicly traded companies. Together, they imprison thousands of immigrant detainees across the country.

According to Bloomberg, GEO Group is the larger of the two, running 11 immigrant processing centers around the country and one family residential center under a contract with Immigration and Customs Enforcement (ICE). CoreCivic runs eight, including a facility for families in Dilley, Texas.

In June, CoreCivic CEO Damon Hininger appeared jubilant at the future prospects for his company. At an investor conference in New York, Hininger touted “the most robust kind of sales environment we’ve seen in probably 10 years, not only on the federal side with the dynamics with ICE and Marshals, but also with these activities on the state side.”

CoreCivic gets more than 80 percent of its earnings from owning and operating prisons, jails, and detention centers, Hininger said at the conference.

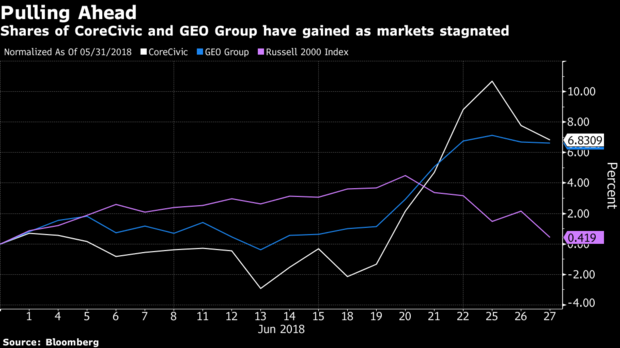

Both CoreCivic and GEO Group have benefitted under the Trump administration. In February 2017, Attorney General Jeff Sessions reversed an Obama-era decision to phase out the federal government’s use of for-profit prisons.

These corporations also face allegations that they force detained immigrants to perform unpaid labor inside their facilities, a kind of modern slavery. Last year, a federal judge ruled that a class-action lawsuit on behalf of tens of thousands of current and former ICE detainees could proceed. The lawsuit asserts that these detainees were subjected to practices that violate federal anti-slavery laws, including the Trafficking Victims Protection Act.

Both GEO Group and CoreCivic are real estate investment trusts, which must pay 90% of their profits to shareholders in the form of dividends. Their stock prices as of this writing indicate investor optimism about continued demand for their services.

And although the profits from these prison companies have been rising, many conscientious investors are choosing not to invest in them because of their participation in a misguided immigration policy.

Remembering that we as investors are part owners of these companies helps to frame the issue more clearly. Many people would balk at the idea of physically owning or collecting rent from an immigration detention facility, but investors who own GEO Group or CoreCivic stock are effectively doing that, although they most probably don’t realize it.

It’s possible that you own these stocks in your retirement account. If you’re concerned, you can ask your company’s human resources department which funds your account is invested in and if prison-free funds or other ethically screened investment options are available.

Making the choice to divest or refrain from investing in for-profit prisons is the least we can do to object to a continuation of today’s immigration mess.

Joshua Brockwell is Investment Communications Director at Azzad Asset Management, a socially responsible registered investment advisor located in Falls Church, Virginia. As a matter of policy, Azzad does not invest in for-profit prison companies in any of its funds or portfolios.

You can find more information on for-profit prisons in these previous blog posts:

August 22, 2016: Why Azzad didn’t invest in private prisons

March 8, 2017: Private prisons: Wrong at any price