The U.S. stock market this year has given total returns so far of close to 10 percent, which is a good thing for investors. But with the exception of savings in retirement accounts such as 401(k)s and individual retirement accounts (IRAs), Uncle Sam will probably take a cut of your newfound wealth in capital gains tax.

An increase in the value of your assets is called capital gains, and how much tax you pay depends on how long you held the investments and how much other income you make.

Long-term vs. short-term capital gains taxes

Long-term capital gains applies to gains (increased value) on investments or other assets you’ve owned for more than a year.

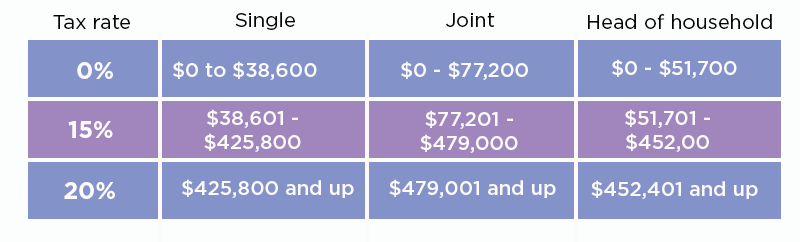

The current capital gains tax rates under the new 2018 tax law are zero, 15 percent, and 20 percent, depending on your income. This chart shows the brackets.

2018 long-term capital gains tax brackets

For example, a married couple filing jointly pays no capital gains tax if their total taxable income is less than $77,200. They’ll pay 15 percent on capital gains if their income is between $77,201 and $479,000. For couples above that income level, the rate is 20 percent. In addition, capital gains may be subject to the net investment income tax (NIIT) of 3.8 percent for people whose income is above certain amounts.

By contrast, short-term capital gains are from assets you buy and sell within one year. They are taxed as regular income, which is always higher than the long-term capital gains rate. The government gives you a break on long-term gains to encourage buy-and-hold investments (as opposed to speculating).

How capital gains taxes work

Let’s say you buy $1,000 worth of stock in January and sell it in June for $1,200. You’ve made short-term capital gains of $200. You and your spouse have taxable income of $85,000 (including your stock gain), which puts you in the 24 percent income tax bracket. So you’ll pay $48 of that $200 gain to Uncle Sam, leaving you with $152.

Consider, instead, that you hold on to your stock until the following January, at which point it has earned $400. Now it’s a long-term capital gain, and your family income puts you in the 15 percent bracket for that gain. Now you’ll pay $60 in tax, realizing a $340 profit. In other words, by doubling the length of your investment you have more than doubled your actual profit, by taking advantage of the favorable tax rate for long-term capital gains.

What counts as a capital gain?

Capital gains are basically any profits resulting from the sale of assets. That includes the sale of tangible assets such as artwork, a car, or a boat–assuming you sell for more than you paid. It also includes the sale of real estate, with some tax exemptions for your principal residence.

Stock dividends also count as capital gains. If you have a lot of dividend gains outside of retirement accounts, your Azzad advisor can help you reinvest those gains in ways to mitigate the tax bill.