U.S. tax law has changed since you filed your federal taxes for 2017; the Tax Cuts and Jobs Act takes effect for 2018 tax filings. Since charitable giving is one of the few deductions that wasn’t eliminated or capped, donations to registered nonprofits are one of the best ways to reduce tax payments for taxpayers who itemize.

If charitable giving plays a role in your tax filing, here are five things you should keep in mind for tax-smart strategic giving and your 2018 taxes.

1. Start planning now

If you plan to claim charitable donations on your 2018 taxes, it’s a good idea to start talking to your financial advisor now so you have time to make informed decisions.

If you received a windfall or more taxable income than you expected this year, charitable giving can be especially important to help offset the corresponding increase in taxes. This could apply if, for example, you got a big bonus this year, if you sold a business, or if the assets in your portfolio greatly increased in value in 2018.

2. Evaluate your options for HOW to give

You may already know which charities you want to support, but from a tax perspective, it’s important to consider how you give money to them.

Your Azzad financial advisor can help you understand how vehicles like donor-advised funds, charitable lead trusts, or private foundations can help you with your taxes while you help the causes that are important to you.

3. Evaluate your options for WHAT to give

Did you know that it’s more tax efficient to donate appreciated stocks than to sell those stocks and donate in cash? With the steady rise in stock markets over the past few year, it’s likely that you own highly appreciated stocks. If you donate them directly to a nonprofit rather than selling them and donating cash, you can avoid the capital gains tax on those shares. (And as a registered nonprofit, the charity won’t have to pay tax either.)

If donating appreciated stocks allows you give a larger sum to charity, then not only will the charity get more money for its mission, but you’ll be able to take a bigger deduction on the donation.

Donating appreciated stocks rather than selling those shares and donating the proceeds means more money for both the charity and you: the charity will get a bigger donation because you didn’t have to pay taxes on the sale, and you’ll get to take a bigger deduction because your donation was greater.

4. Decide whether or not to itemize

Even with this year’s lower tax brackets, some households might be surprised by their taxes this year. Because the standard deduction was nearly doubled, fewer taxpayers are expected to itemize. However, the majority of high-income households will probably continue to itemize. Here are some things you should consider when deciding whether or not to itemize.

For people who expect to itemize:

- • The new law limits or removes some deductions, such as mortgage interest and state and local taxes. People who previously counted on those deductions may want to increase their charitable giving to offset lost tax deductions.

- • The new law still allows you to deduct up to 30% of your adjusted gross income (AGI) for appreciated non-cash donations.

- • The new law increases the amount you can itemize in cash donations, up to 60% of your AGI. (Previously it was 50%)

For people on the cusp of itemizing:

If your income places you in a position where there’s little difference between itemizing or taking the standard deduction, this strategy could be a good option to increase your tax deduction in the long run.

Concentrate giving: alternate itemizing larger charitable donations every other year with taking the larger standard deduction.

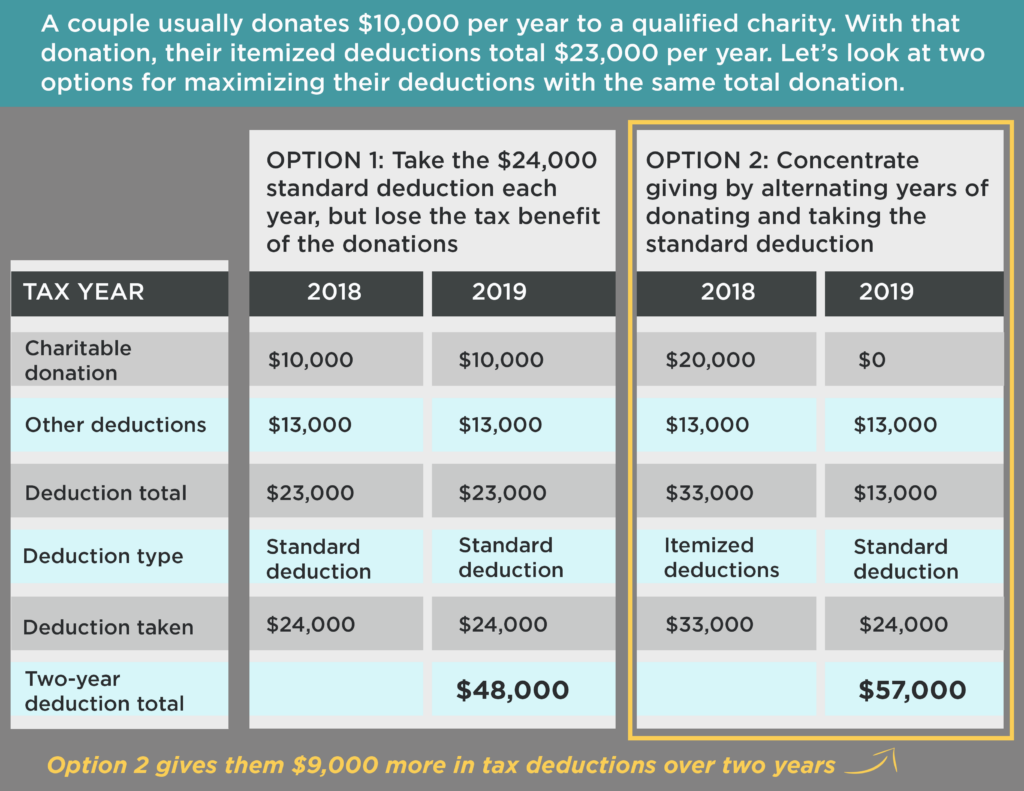

Let’s look at an example of a couple who usually donate $10,000 per year and deduct it on their taxes. With this donation, their total itemized deductions total $23,000.

Under the previous tax law with its lower standard deduction, their best tax option was to donate the $10,000 and itemize deductions each year.

With the new tax law and its higher standard deduction, a better option for them is to concentrate their charitable giving — donating $20,000 every other year — and alternate itemizing with taking the standard deduction. In the year they donate $20,000, their itemized deduction will be much greater, and in the alternating years they can take advantage of the higher standard deduction.

If you want to try this strategy without interrupting your usual charitable giving schedule, a donor-advised fund can help you keep your charitable donations consistent, while maximizing their tax value for you. (See more below)

5. Donor-advised fund: Invest your charitable donations ethically

If charitable giving is part of your tax strategy, you might want to consider creating a donor-advised fund to receive your charitable donations. Essentially, a donor-advised fund is a charitable account to which you make tax-deductible donations. Then you direct those funds to be donated to qualified charities of your choice, without being restricted by tax-related deadlines.

Here are a few of the benefits of a donor-advised fund:

- • You can make the charitable donations you need each year for tax purposes, and then direct money from the account to be donated to charities as opportunities arise. Having a donor-advised fund allows you to separate your charitable giving from your tax deduction deadlines.

- • If you donate long-term appreciated stocks, mutual funds, or other securities directly to your donor-advised fund, you can avoid paying capital gains taxes on the sale of those assets. Then you can direct those assets to be sold in the fund and the proceeds donated to charities of your choice, tax free.

- • Once you’ve donated money or securities to your donor-advised fund, they can grow tax-free until you direct them to be donated to charity. This can potentially increase the amount you have to donate. Of course, make sure you invest your DAF in mutual funds or portfolios that align with your values.

You can open a donor-advised fund account with Azzad with as little as $5,000. We will professionally manage your account and work with the account’s third party administrator. The administrator will make grants from the account to the charities you select.

Call us at 703-207-7005 to get started or to learn more.

This article is intended for educational purposes only; it is not individualized tax advice. You should consult a tax professional for advice specific to you. Azzad does not provide tax or accounting advice.