Most people know the basics of Islamic finance: avoid interest, stay away from prohibited lines of business, and make sure your advisory board has the right credentials. But it’s not every day that people talk about zakah and purification. Both concepts are inseparable from Islamic finance but are regularly omitted from the conversation. Let’s look at why this is and what’s being done about it.

Key terms

As the third pillar of Islam, zakah is universally recognized among Muslims as a requirement for the proper management of their finances. Every Muslim must pay zakah on certain types of assets that have a value above a minimum amount and that they have owned for at least 12 lunar months.

Purification is an essential though lesser known aspect of Islamic investing that involves the donation of income earned from any unacceptable business activities by companies in which a shareholder is invested. Since it is possible to unintentionally earn small amounts of prohibited income from otherwise permissible investments, Islamic scholars advise cleansing accounts of such money. Because zakah is not paid on amounts coming from unacceptable or impure sources, purification amounts are calculated first and then subtracted from account balances before determining zakah totals. The process results in two dollar amounts, both of which are to be given to charity.

Putting it into practice

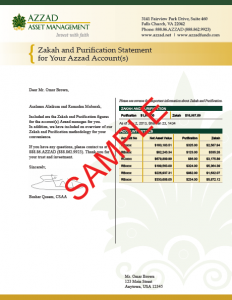

Part of the reason zakah and purification are not always talked about stems from their complexity. Azzad has sought to take the confusion out of calculating zakah and purification amounts by automating the process and issuing standardized statements for our clients on an annual basis.

Following best practices and guidelines issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), Azzad uses AAOIFI Standard Number 21 as the basis for our proprietary zakah and purification calculation program.

Each year, we calculate hundreds of thousands in purification and millions in zakah for our clients to pay to the charities of their choice.

Long story short: an American Muslim investment firm is putting the loftier goals of Islamic finance, including zakah and purification, into practice right here in the United States.