As the 2016 presidential campaign gets into full swing, voters across the country have an opportunity to hear directly from the candidates on important issues. Neither of the two major political parties has taken a coherent, ethically rigorous stance on hydraulic fracturing, or “fracking.” But there are other ways for the ecologically conscious to make their voices heard on this issue, including voting with their pocketbooks.

Fracking, which involves using a highly pressurized mix of water, sand, and toxic chemicals to unlock oil and natural gas from shale rock buried miles underground, is recognized by experts as dangerous. Fracking can cause methane leaks (a greenhouse gas that’s much more harmful than carbon dioxide) and seismic activity and can set water ablaze. And if methane, flammable water, and earthquakes weren’t bad enough, other problems with fracking include excessive water consumption, waste management issues, and air pollution.

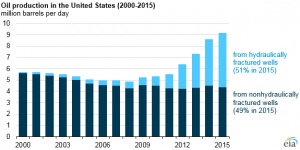

Thanks to fracking, the United States is now the world’s leading producer of oil and natural gas, according to the U.S. Energy Information Administration (EIA). EIA estimates that total U.S. gas production from 2012 to 2040 will increase 56 percent, with natural gas from shale as the leading contributor. The shale gas share of total U.S. production is projected to increase from 40 percent in 2012 to 53 percent in 2040.

To varying degrees, the nominees from both major political parties have embraced fracking, from Hillary Clinton’s promotion of fracking around the world as secretary of state to Donald Trump’s promises to roll back regulations on oil and gas production in the United States. Where does this leave mainstream voters who want to push back against the many dangers of this growing industry?

One viable option for those who object to the rise of fracking and the inadequate response from politicians is to directly divest from companies engaged in the practice. This means dumping the stocks of fracking companies from investment portfolios.

And just like the growth of the fracking industry, the movement to divest is picking up steam.

Over the last five years, a growing campaign for divestment not just from fracking but from fossil fuels as a whole has spread to hundreds of universities, cities, religious institutions, and asset management firms. In addition to ethical objections, institutions often cite as a rationale for divestment the potential economic cost of carbon, either as a stranded asset or an overly taxed and regulated commodity in the future. There are more than 20 academic studies from leading scholarly institutions, as well as a cross-study analysis by Deutsche Bank, showing that environmental—along with social and governance—factors can reduce risk and potentially enhance financial returns for investors.

The divestment movement is aided by the push for greater disclosure from fossil fuel companies in addition to the ability to name and shame the most heinous offenders.

For instance, the 2015 Disclosing the Facts report from As You Sow, Boston Common Asset Management, and the Investor Environmental Health Network ranks the 30 largest oil and gas companies engaged in fracking and gauges how well they do in providing information so that investors can assess their performance.

The latest results: 70% of the top 30 oil and gas companies do not adequately disclose the risks of fracking to investors. Furthermore, no companies have set public goals for reducing emissions from methane, and overall, most companies still suffer from a lack of transparency.

For many environmentally conscious Americans, the choice in November will be a difficult one. But regardless of political persuasion, we should all support the idea of using our dollars to express our values. Whether it’s Election Day or not, you can always register your protest vote against fracking through divestment. And you’ll probably get more peace of mind than voting for either political candidate this electoral season.

Joshua Brockwell is Investment Communications Director at Azzad Asset Management, a socially responsible registered investment advisor located in Falls Church, Virginia. Azzad is the sponsor of the Azzad Ethical Fund, a mid-cap growth mutual fund that has a policy excluding hydraulic fracturing companies as candidates for investment.

You should consider the Fund’s investment objectives, risks, charges and expenses before investing. A prospectus with this and other information about the Fund is available online at www.azzadfunds.com/prospectus or by calling 888-86-AZZAD. Please read the prospectus carefully before investing. Azzad Asset Management is the investment advisor to the Azzad Funds. The Funds are self-distributed.

The opinions and views expressed herein are solely those of the author and may not reflect the opinions and views of Azzad Asset Management. They are current as of the date indicated, are subject to change without notice, and do not take into account particular investment objectives, financial situations or the needs of individual investors. They are not intended to be relied upon as a prediction or forecast of actual future events or performance, a guarantee of future results, recommendations or advice. Statements made in this material are not intended as buy or sell recommendations of any securities. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed. This information has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed.