A lot of people contact us asking about buying real estate. “It’s a hard asset and they’re not making any more of it,” they say.

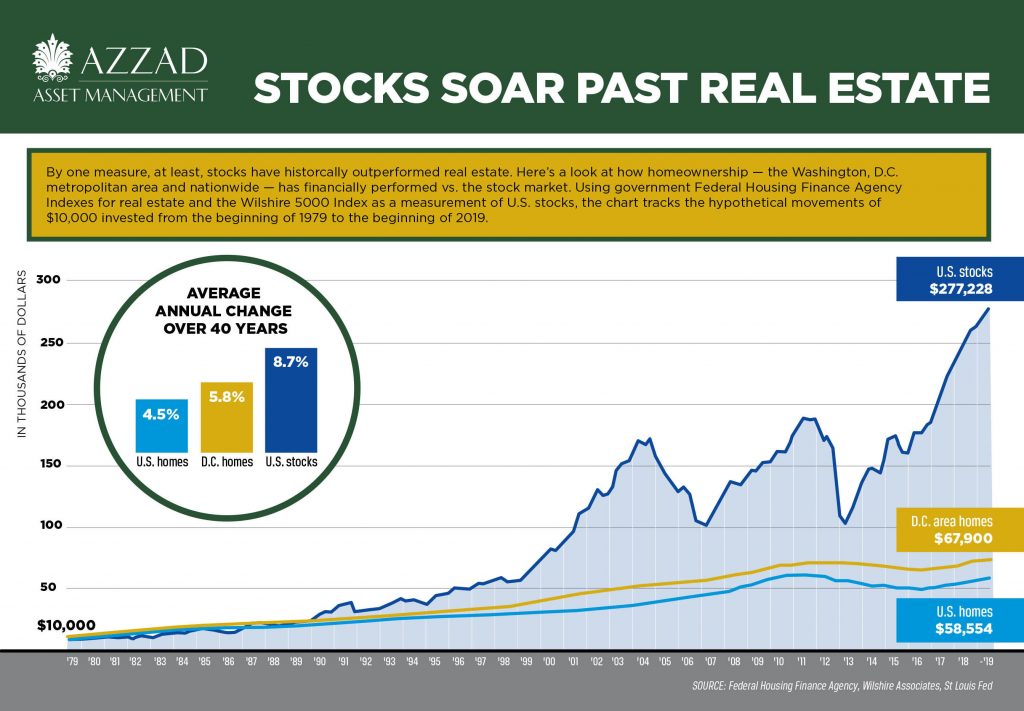

When we’re asked this question, we try to explain the advantages of owning stocks instead of or in addition to real estate. One way we do this is explaining how our portfolio managers pick stocks, and then comparing the costs of stocks to real estate.

Picking stocks isn’t that different from looking for a good piece of real estate. First, you look at the quality (who built it, where it is, etc.). Then you figure out its worth, or valuation. Next up, you figure out your best- and worst-case scenarios for rent and taxes. (For stocks, you look at things called price-to-earnings ratios and cash flow return on investment). When the real estate is priced below your worst-case scenario, you buy it.

That’s how it works with most stocks, too.

There are, however, a couple of differences between real estate and publicly traded stocks, namely liquidity and low transaction costs. This ought to make real estate investors sit up and take notice.

Let’s look at liquidity first. If you need cash, selling real estate may take months or even years. Compare that to stocks, which are bought and sold every second of the trading day, Monday through Friday.

Transaction costs are another big disadvantage of real estate, making up 3%-7% of the value of land. If we’re talking about housing, combined costs could be as high as 14%. Stocks can be bought and sold for much less.

Even if you’re still inclined to own real estate, there are smarter, more efficient ways of doing it through the public markets. Real estate investment trusts (REITs) hold many different properties, reducing the risks associated with owning just one. Azzad’s REIT portfolio is an example of how you can still own real estate and reduce the liquidity and transaction cost issues we mentioned earlier.

Whatever your inclination, remember that stocks are reasonably priced and efficient. They are important tools to beat inflation and earn a rate of return that meets the demands of retirement. Simply put, there’s no better way to build wealth over the long term.