Different types of investments perform better in different market conditions. Investing in a variety of assets like stocks, fixed income, and real estate can result in better diversification and help reduce the risk for your overall investment portfolio. In fact, one study found that how you diversify your portfolio can account for more than 90% of your investment performance. (Brinson, Beebower, and Hood, “Determinants of Portfolio Performance,” 1986.)

Diversification can work over time, but not every time

In recent years, the S&P 500 index, a benchmark composed of the 500 largest US stocks, has overshadowed the performance of other sectors in the market such as commodities and fixed income. This has caused some to question the benefits of diversification, which can require more oversight and cost than a low-cost large cap index fund. While diversification will not guarantee you the best returns each year, it can help you achieve results tailored to your financial goals over time with less expected risk.

Diversification is often confused with asset allocation, but not all asset allocations provide the same level of diversification. For example, if your portfolio is divided evenly among different types of the same asset (e.g., U.S. stocks, European stocks, and Japanese stocks), it might not help much if stock markets decline worldwide.

True diversification means investing in a mix of assets that perform differently in various markets. If stocks fall globally, other assets can sometimes help support your portfolio until stocks recover.

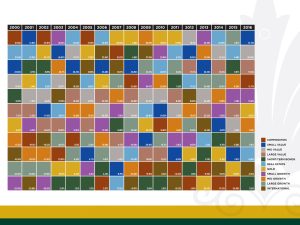

The chart below shows the periodic table of investments, highlighting the performance of different asset classes over the last 17 calendar years. Each colored box represents a different kind of investment. For example, in 2013, U.S. small cap growth stocks were the best performing asset class, while gold was the worst performer, losing 28% during the year.

Source: Morningstar. Data as of 12/31/2016. Past performance is no guarantee of future results. Each index reflects a group of unmanaged securities. It is not possible to invest directly in an unmanaged index. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Diversification, rebalancing and dollar cost averaging are investment strategies that cannot ensure a profit or eliminate the risks of investing. This chart is not indicative of the past, present or future performance of any Azzad investment products.

You’ll notice that there isn’t one consistent winner across the entire timeframe. Sometimes commodities perform the best; other times it’s large cap stocks. The moral of the story is to spread your money around to gain exposure to the possible overachievers.

Diversification – asset classes working together

Diversification works in a manner similar to a rowing team. Each rower has a position and a particular skill that helps the boat move forward. Some rowers are responsible for stability and steering while the physically strongest rowers are responsible for propelling the boat forward. Each rower has a specific role to play in helping the team win the race.

Diversification can’t solve all problems, however. Generally, it won’t give you the highest possible rate of return. This means your portfolio is not likely to outperform the top performing asset class of a given year. But here’s the important part — no one can predict the top winner each year. Going back to the periodic table of asset classes, between 2000 and 2016, only twice did an asset class rank in first place two years in a row. It’s more important to invest across a range of asset classes to help get the best possible return with lower expected risk.

Though you won’t be beating the market every year, diversification can help you to stay within a risk spectrum that’s right for you. It can help you avoid taking bigger risks than you can handle while still allowing you to take enough risks to meet your financial goals.

Through diversification, you can rebalance asset classes to account for changes in the market without trying to time the market. You can move from riskier asset classes that might offer higher returns to less risky asset classes when downside protection becomes a higher priority. Think of asset classes as being different friends to lean on at different times.

How we diversify at Azzad

We take portfolio diversification seriously – we believe it’s one of the biggest determinants of a portfolio’s success. Keeping this in mind, we use a three-step approach to diversify our clients’ investments in the Azzad Ethical Wrap Program, the turnkey wealth management solution that invests in many of the asset classes shown on the periodic table of investments above.

We first diversify our clients’ portfolios across different asset classes (e.g., different market cap stocks, halal fixed income and real estate investment trusts (REITs)).

Next, we spread money within different asset categories. For example, we don’t consider stocks as a whole to be one asset class, as large- and small-company stocks can perform differently).

Lastly, Azzad offers an important extra layer of diversification by following a multi-manager strategy. We select professional money managers to manage different asset categories, each specializing in their specific strategy. Each component of the Azzad Ethical Wrap Program is managed by professionals who are committed to investing your money according to Azzad’s ethical investment guidelines.

Think of us as a coach who combines the talents of various players into a single team, getting the most out of each player.

It’s just one of the many ways we are looking out for our clients’ interests.

Diversification, asset allocation and a multi-manager approach cannot protect against a loss or ensure a gain. Investing involves risk and you can lose money investing in the stock markets. For more information about the Ethical Wrap Program, please request and read the wrap’s brochure before sending any money. A free copy may be obtained by calling us at 888.862.9923. Prospect clients should also read Azzad’s firm disclosure available on part 2A of our ADV. Please call us to obtain your free copy.

Note about the periodic table:

Large-Cap Value Stocks are represented by the Russell 1000 Value Index, which measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Mid-Cap Growth Stocks are represented by the Russell Mid Cap Growth Index, which measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

Mid-Cap Value Stocks are represented by the Russell Mid Cap Value Index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values.

Small-Cap Growth Stocks are represented by the Russell 2000 Growth Index, which measures the performance of those Russell 2000 companies with higher price to book ratios and higher forecasted growth values.

Small-Cap Value Stocks are represented by the Russell 2000 Value Index, which measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

International Stocks are represented by MSCI ACWI Ex USA USD which is a market-capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI) and designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies. The MSCI All Country World Index Ex-U.S. includes both developed and emerging markets.

Real Estate Stocks are represented by the DJ US Select REIT TR USD, which tracks publicly-traded Real Estate Investment Trusts in the U.S.

Short-Term Bonds are represented by the BofAML US Corp&Govt 1-3 Yr. TR USD.

Commodities are represented by BLOOMBERG COMMODITY INDEX TR USD.

Gold and Silver are prices are derived from GLD and SLV ETFs (Source: Morningstar).