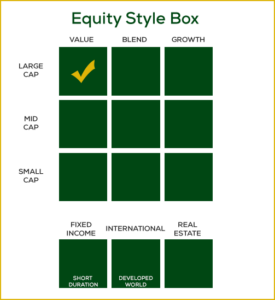

Large Cap Value Portfolio

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

Why Large Cap Value Stocks?

Large cap value stocks are attractive for their stability, steady performance, and potential for long-term capital appreciation. Representing well-established companies with market capitalizations typically over $10 billion, these stocks are considered undervalued based on metrics such as price-to-earnings or price-to-book ratios. Their undervaluation often signals potential for price appreciation as the market corrects itself.

Large cap value stocks are attractive for their stability, steady performance, and potential for long-term capital appreciation. Representing well-established companies with market capitalizations typically over $10 billion, these stocks are considered undervalued based on metrics such as price-to-earnings or price-to-book ratios. Their undervaluation often signals potential for price appreciation as the market corrects itself.

Investing in large cap value stocks provides stability and lower volatility compared to smaller cap stocks. These companies usually have solid balance sheets, strong cash flows, dividends, and established market positions, making them more resilient during economic downturns. This resilience offers a safer investment, particularly for conservative investors seeking reliable returns.

SKBA Capital Management, LLC was founded in 1989 by members of the investment team working within the institutional trust department at the Bank of California. The core of the investment team has worked together for over 25 years. SKBA is a 100% employee and founder owned investment adviser registered with the Securities and Exchange Commission.

The firm employs a collaborative team approach to investing which brings together over three decades of experience to investment management. SKBA’s goal is to emphasize long-term wealth accumulation while avoiding risk of a permanent loss of capital. Its managers are disciplined, value managers.

Meet the Managers

Evan Ke, CFA®, Director of Quantitative Research

Mr. Ke is the Director of Quantitative Research. He is a member of the Investment Strategy Team and is also a securities analyst. Mr. Ke joined SKBA in 2009 as a member of our research internship program and rejoined SKBA in 2011. In between employment at SKBA, Mr. Ke worked in the equity research department at Piper Jaffray. Mr. Ke received a Bachelor of Arts in economics from the University of California at Berkeley. Mr. Ke is a member of the CFA® Society of San Francisco and the CFA® Institute. Mr. Ke is an equity owner of the firm.

Matthew R. Segura, CFA®, Director of Institutional Portfolio Management

Mr. Segura is the Director of Institutional Portfolio Management. He is a member of the Investment Strategy Team and is also a securities analyst. Mr. Segura joined SKBA in 2007 as a member of our research internship program and rejoined SKBA in 2011. Previously Mr. Segura worked at Charles Schwab & Co performing several roles: A Cash Management team member in the Treasury, and a Manager in Financial Planning and Analysis for Schwab’s largest retail divisions. Mr. Segura received a BS in business administration from Haas School of Business at UC Berkeley and is a member of the CFA® Society of San Francisco and the CFA® Institute. Mr. Segura is an equity owner of the firm.

Investment Approach

SKBA manages the Large Cap Value model using its ValuePlus investment strategy. Investments are selected from a universe of securities passing Azzad’s ethical screens. The strategy seeks to achieve long-term capital appreciation by investing in a diversified portfolio of large cap, undervalued securities. SKBA incorporates a bottom-up, fundamental research process that invests in companies that pass its proprietary initial valuation framework. Only companies that pass SKBA’s initial valuation metrics make it to the next stage where a company’s earnings power is carefully analyzed. SKBA focuses on a company’s balance sheet and income statement strength, competitive position and overall industry prospects, as well as management’s alignment with shareholders’ interests.