In order to help clients navigate the extreme market volatility related to the coronavirus pandemic, we’ve put together the list of FAQs below. Check back often as this list will be updated. For more information and assistance, please contact your Azzad advisor at 888.86.AZZAD.

We will continue to monitor developments of COVID-19 and its impacts as information becomes available. We advise clients to stay patient and stick to their strategic asset allocation. Thank you for your continued trust and investment.

Q: What options are available to small business owners who want to retain their employees but need temporary help?

A: Many of our clients are small business owners, and some are searching for answers in this difficult time. Current economic conditions have adversely affected financial performance, and managers being forced to make some hard decisions.

First, try to avoid panicked moves, like layoffs, until you’ve considered options to help control costs. Even a temporary reduction in employees’ salaries is a better option than letting people go–both for you and them.

As for government aid, Congress is taking steps to alleviate the suffering of small businesses. There are three phases of coronavirus-related relief legislation, two of which have been signed into law by President Trump. The third is almost complete.

Phase 1: This initiative removed regulatory hurdles and authorized the SBA to provide an estimated $7 billion in low-interest disaster loans to small businesses. To enhance the process, the legislation provides $20 million to cover SBA expenses in this effort.

Phase 2: On March 18, President Trump signed H.R. 6201, the Families First Coronavirus Response Act. In addition to paid leave and food assistance to individuals, the measure provides tax credits to employers to offset the costs of providing emergency paid leave, and require insurers, Medicare, Medicaid and other federal health programs to fully cover testing and related services for the virus.

This law includes a provision that allows the Secretary of Labor to exempt small businesses with fewer than 50 employees from the paid leave requirements.

Phase 3: Congress agreed to and passed an additional $2.2 trillion economic stimulus package called the Coronavirus Aid, Relief and Economic Security (CARES) Act. It includes $367 billion for small businesses, among other provisions. It was signed into law by President Trump on March 27.

Phase 4: On April 24, President Trump signed the nearly $500 billion “Phase 3.5” emergency interim coronavirus relief package into law, replenishing the fund for small businesses and adding billions of dollars in aid to hospitals across the country amid the COVID-19 pandemic.

The Paycheck Protection Program (PPP) and Health Care Enhancement Act provides an additional $310 billion to fund the PPP, as well as $60 billion for the Small Business Administration’s (SBA) Economic Injury Disaster Loan program, $75 billion for hospitals and health care providers, and $25 billion to expand COVID-19 testing.

Watch our webinar on the provisions for small businesses in the CARES Act here.

Q: I am considering laying off some of my employees. Should I?

A: Many employers are enacting cost-cutting measures such as laying off employees and cutting hours. Although you’re in the best position to know what you can and cannot afford, we highly recommend that you leave laying off employees as a last resort. Employers who are able to navigate the economic effects of this crisis in a compassionate way will create more value for their businesses in the long run and will emerge out of this pandemic stronger than ever. By most estimates, this pandemic will be over in a few months. When the dust settles, your former employee(s) may not be available for rehiring. You’ll have to hire and train new employees which can be very expensive (some surveys estimate it to cost around 30% of that employee’s first year’s salary, depending on the position and location) and will most likely undermine your company’s profitability.

So, before laying off a single employee, we recommend you consider the following measures:

Communicate honestly with your employees. Your employees are likely feeling anxious about their jobs. Instead of forcing them to second-guess what may be in store for them, be very open about the financial health of your business and what goals you will prioritize. These goals won’t be the same for every business and you shouldn’t make empty promises or confusing statements. Instead, communicate your new priorities such as “our goal is to save jobs while meeting our loan obligations”.

We’re all in this together. Share your pain. Temporarily cutting your employees’ salaries to save job losses could be a feasible option for some businesses. However, as the boss, remember that you are your company’s leader so it is vital that you lead by example. That means forgoing your salary or taking the largest pay cut. If you decide to halt bonuses, make sure it’s across the board, beginning with yourself.

Crowdsource ideas from your employees. By asking your employees for ideas on what the company should do, you’ll have stronger buy-in for the initiatives you eventually prioritize. Many employers resist asking their employees for their ideas because they fear they’ll be resentful when their ideas aren’t implemented. In our experience, employees will not only appreciate this openness, but they are likely to also work on your behalf to persuade any disgruntled co-workers. Just make sure to stay in control of this process by articulating that you intend to prioritize initiatives with lower risk profiles, proven positive impact on cash flow, and a higher chance of saving jobs.

Consider all your options for reducing costs. Consider less conventional options such as moving your business to a shorter work-week, moving some employees to part time or giving unpaid leave to others. If you’ve communicated your intentions to your staff, namely that you’re trying to avoid laying employees off, you’ll discover they’re more likely to accept making certain temporary sacrifices.

We understand that being the leader of your company during these turbulent times can be challenging. If you act too quickly and lay off your employees, you may discover that you overreacted. If you act too slowly, your business may suffer. However, if you lead with compassion and empathy, you will touch the lives of your employees in an extraordinary way and come out of this crisis stronger than before.

Q: What are some key considerations and actions that small business employers can take during this pandemic?

A: Employers are navigating in uncharted territory, and although every business is unique, there are some key actions every employer may want to consider implementing during this pandemic.

First, to maintain the health and wellness of your employees, it’s vital that you try your utmost to reduce potential transmission among your staff. You can accomplish this with preventive wellness practices such as washing hands and disinfecting work surfaces. Make sure you’re regularly cleaning your office facilities with bleach or alcohol-based wipes. Also, actively encourage any sick employees and contractors to stay home. If you do not have a sick leave policy, now is the time to consider implementing one. Think about employees who may be at higher risk to COVID-19, such as those over the age of 60 and those with chronic medical conditions. If your business allows it, consider allowing these employees to work remotely.

The next key consideration for many employers will be to ensure that you have a thorough business continuity plan. Your plan should consider flexible or remote work practices. Although we recognize that not every business will lend itself to remote work, there may be certain job functions that can be accomplished remotely. Modern technology has enabled even health care professionals to consult with their patients by using HIPAA compliant video-conferencing tools. This concept, referred to as telemedicine, makes healthcare more accessible, cost-effective and increases patient engagement. For other businesses, remote work may be as simple as subscribing to a web or video conferencing service and ensuring you have enough bandwidth to continue operations. If remote work is not viable for your business, consider whether you can implement flexible work hours or staggered shifts to help increase the physical distance among employees.

Finally, you’ll need to think about how your business will respond in the event that this illness touches your operations directly. Employees who become ill after arriving to work (and show symptoms such as fever, cough or shortness of breath) should be immediately separated from other employees and sent home. Be aware that you’re still obligated to maintain that employee’s confidentiality as required by the Americans with Disabilities Act (ADA), but you should inform fellow employees of their possible exposure to COVID-19. In addition, cross-training your key employees or making sure that more than one employee can carry the functions of another is vital for the continuation of your business.

Implementing a sick leave policy, developing your business continuity plan and cross training your key employees are best business practices. It is not too late to start implementing these practices for your small business.

Q: I am worried about being cash strapped in a few months. What should I do?

First of all, you’re not alone. A recent Federal Reserve study, showed that 40% of Americans couldn’t even afford a $400 emergency repair.

It’s okay to sell some of your investments to raise immediate cash. We often preach the virtues of staying the course, but it’s reasonable to have liquid assets on hand. Sometimes you need to change your mentality to a cash preservation mode. In those situations, it’s good to have a “bucket approach” to your investments.

The idea behind the bucket approach is to divide your portfolio into several different buckets, with transfers between those buckets carefully structured. The first bucket would contain enough cash and liquid assets to meet immediate expenses (say, within the next six to twelve months), with another bucket containing slightly riskier assets like fixed income for needs anticipated within the next five years. The third bucket would be for longer-term investing, allocated specifically to stocks. That first bucket would be replenished only when riskier assets perform well. Bucket approaches have great intuitive appeal, since they insulate investors from concern about the impact a bear market might have on their immediate expenses.

I feel like I should do something with my portfolio. What are some practical steps I can take now that markets are lower than they were to start the year?

It’s true that nothing eases anxiety more than taking some proactive steps. And while you shouldn’t tinker with your portfolio if you’ve already got a plan in place, there are some smart ways to respond to today’s lower market. Here are three things to think about:

Tax Loss Harvesting

With global equities having declined 20 percent in the first quarter, investors may now have positions in taxable accounts with unrealized losses. In such instances, an investor may want to consider harvesting the loss or selling securities that have declined below their initial purchase price. In doing so, a realized loss is produced for tax purposes. Tax-loss harvesting may help investors reduce their current tax liabilities for taxable accounts.

Realized losses can offset realized gains. To the extent realized losses exceed realized gains in a given tax year, up to $3,000 of losses can be applied against ordinary income with any excess producing a loss carryforward to be used in future tax years. There are several considerations to be aware of prior to harvesting losses for tax purposes, so be sure to understand the pros and cons before selling.

(Note: Azzad Asset Management does not provide tax advice. Clients should consult with their tax advisors regarding the tax consequences of engaging in tax-loss harvesting. Tax-loss harvesting may create potential capital gains and wash sales.)

Rebalancing

This is the process of periodically comparing your original asset allocation to your current portfolio, and if the holdings vary more than a maximum threshold (say 5%), then it may be time to rebalance. When you rebalance, you sell a portion of your portfolio that was outperforming and buy more of the underperforming assets to bring the investment mix back the way you originally designed it. By rebalancing your portfolio, you essentially reduce your risk relative to your target asset allocation.

A word of caution: trading during these very volatile days may not be wise for every investor. You should balance your investment plan with current market conditions, your risk tolerance, and time horizon (including potential tax consequences).

For example: March 2020 has entered the history books as the most volatile month in stock market history. Through month-end, the average daily swing for the S&P 500 was 5.75%. On March 12th, the S&P 500 posted a -9.51% loss only to close +9.29% the very next day. If you had rebalanced after the big down day, you could be off target the very next day. Therefore, it is imperative that you consult with your advisor.

Charitable Giving

Ordinarily, an investor with long-term appreciated securities would be better served by gifting such securities rather than cash. However, this general guideline changes a bit given 1) the extent of the recent market decline (stocks were more valuable as of late 2019) and 2) tax changes associated with the recently passed Coronavirus Aid, Relief and Economic Security Act (“CARES Act”).

The CARES Act included a provision removing the adjusted gross income (AGI) limitation for cash contributions made in 2020 to public charities (private foundations, supporting organizations and donor-advised funds are excluded). As such, taxpayers can elect to deduct up to 100 percent of adjusted gross income after factoring in other charitable contributions otherwise subject to AGI limitations. In comparison, the charitable deduction for long-term appreciated securities is limited to 30 percent of AGI for gifts to public charities and 20 percent of AGI for gifts to private foundations. As a result, some taxpayers may find a greater tax benefit in making 2020 charitable gifts through cash rather than securities.

I’ve heard that now may be the time to do a Roth IRA conversion. Is that true?

Individuals with Traditional IRA or 401(k) assets may consider converting all or a portion of their balances to a Roth IRA, as the market selloff has reduced account balances. Roth IRAs have very favorable tax treatment as the account grows tax-deferred, qualified distributions are tax-free and there are no required minimum distributions for the original account owner.

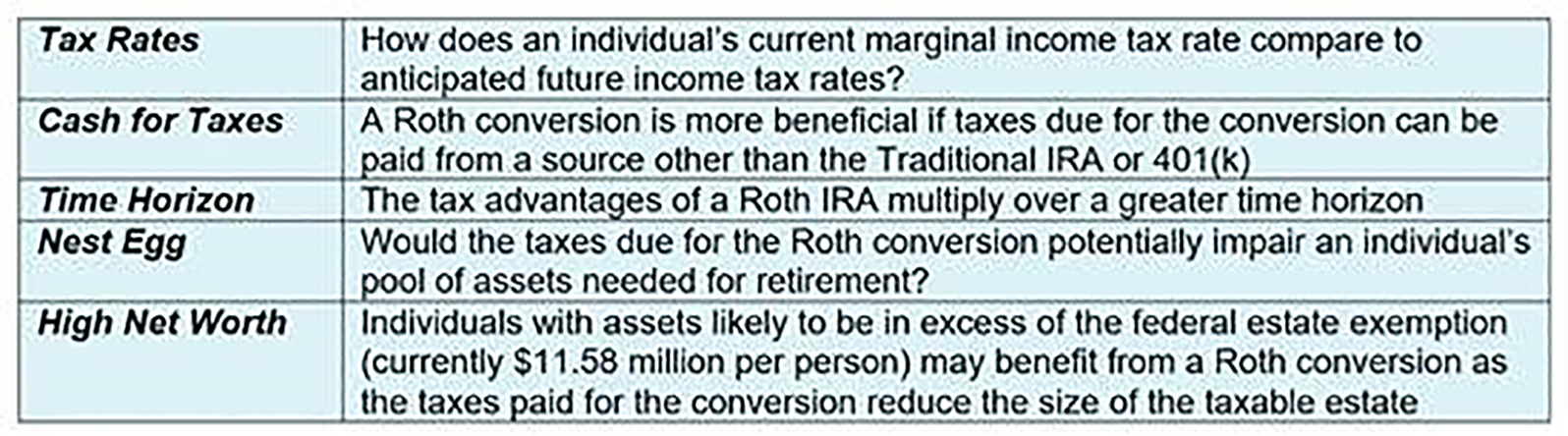

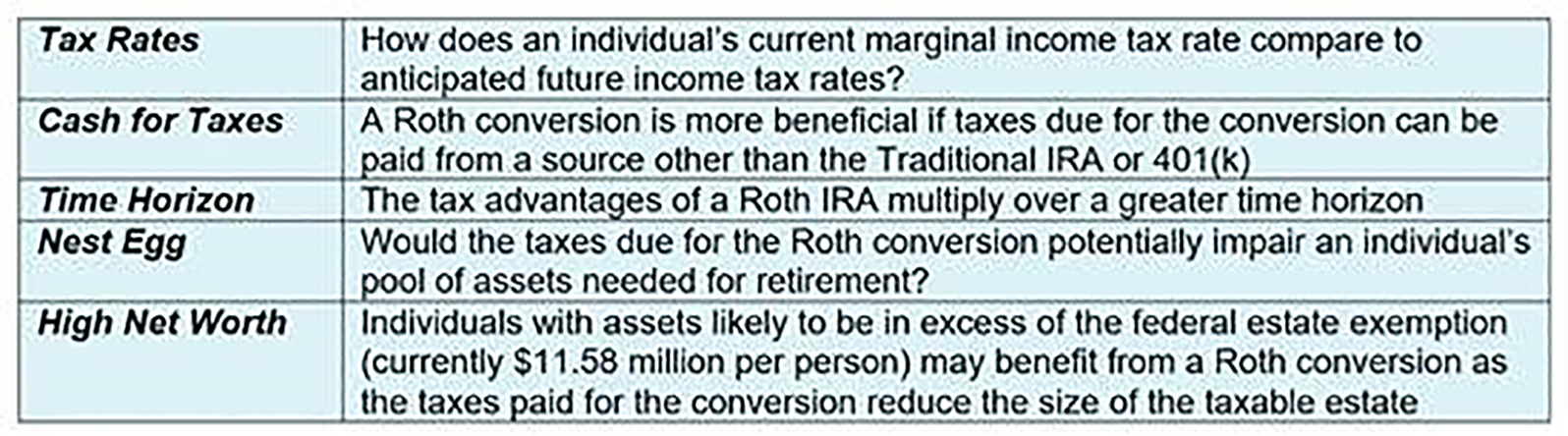

Individuals should recognize that converting a Traditional IRA or 401(k) to a Roth IRA is a taxable event (taxed at ordinary income rates) thus, there are numerous variables to consider including: Also, keep in mind that, beginning 2018, a recharacterization of Roth IRA conversions was repealed. That means you can’t change your mind after you’ve converted your IRA or 401(K) plan into a Roth. As such, there’s a greater emphasis on planning so we recommend you consult with your tax advisor prior to doing any conversions.

Also, keep in mind that, beginning 2018, a recharacterization of Roth IRA conversions was repealed. That means you can’t change your mind after you’ve converted your IRA or 401(K) plan into a Roth. As such, there’s a greater emphasis on planning so we recommend you consult with your tax advisor prior to doing any conversions.

Q: How should I react to these up and down days?

A: First of all, don’t panic. Of course, it’s easy to say, but certainly a lot harder to do. However, panic is not a strategy. It’s harmful to your portfolio, not to mention your physical well-being. Panic intensifies the negative and makes your thinking more biased toward the downside. You’re more likely to predict negative outcomes and to looking for the quickest, easiest way to resolve uncertainty. You also tend to put too much focus on what others are doing, discounting the objective information right in front of you. Too often that means selling stocks when you shouldn’t. To make sure your decisions stand the test of time, take small steps, nothing drastic. And do things in consultation with your Azzad advisor.

Nobody knows when stocks will rise again. However, you should know that the stock market is typically a leading indicator of the economy. It tends to peak before the onset of recession and bottom out before a recovery. The stock prices on your screen these days say nothing about what these companies are actually worth. Stocks’ true worth is what matters in the long run, and their prices eventually reflect that. The value of a company doesn’t change 8%-10% from one day to the next, which means that today’s prices are probably out of whack with the underlying value of the companies their stock represents.

Q: What’s going to happen to the economy?

A: The economy is going to take a meaningful hit through at least mid-2020 and a recession is much more likely than it was several weeks ago. Certain sectors of the economy will be hit particularly hard, but virtually everything will be adversely impacted. However, it’s important to note that markets often rally well before buds of optimism start to grow.

The optimistic scenario for this moment is a sharp but brief economic contraction. Numerous forecasters are now projecting a tumble in economic output, starting in the first or second quarter, followed by a rebound. Not all economic activity is lost. Think of those Clorox wipes people have been buying and all those Amazon orders people have been making. Amazon is even raising wages and increasing hiring right now.

The pessimistic scenario is not as rosy. Human psychology risks creating a cycle of plummeting demand from consumers and businesses, a downward spiral called a “demand shock” that monetary or fiscal policy may be unable to halt easily. Corporations are going to need to unload debt, and the federal government will need to creative with solutions. It’s doable, but it won’t be easy.

Q: Will these wild market ups and downs ever stop?

A: Market volatility is going to remain extremely high for the foreseeable future. However, this too will pass. In the meantime, we need to be ready to face the challenges that will unfold over the coming weeks and try not to get caught up in the emotional swings that can accompany this kind of market volatility. We’ve faced very difficult times in the markets and will face them again in the future. Stay calm and keep your wits about you. And as this chart illustrates, that volatility can be your friend when markets move up. You never know when it’s going to happen, but if the past is any indication, it could be just around the corner. If you ride out those ups and downs, the market may reward you handsomely:

Source: Bloomberg

Q: Why are stocks so much lower all of a sudden?

A: In part, the market drop reflects concern about profits. When the economy shrinks even a little, corporate profits tend to shrink a lot. Businesses’ fixed expenses don’t drop as fast as their revenue. So a relatively small decrease in gross domestic product might mean a big drop in future corporate earnings.

Everyone may recognize that buyers are paying less than the assets are worth in the long term. But in moments like these, that long-term value is not driving the price. Eventually, investors will get a better feel for where we’re headed and swoop in to scoop up bargains. That can, however, take some time.

Over years and decades, stock prices are related to their expected returns in the form of dividends or capital gains. That’s why you shouldn’t panic and sell right now. But over short periods of crisis, when everyone is just trying to figure out what might happen next, markets aren’t efficient in that narrow sense. They can be just as irrational and volatile as we are. So remain patient.

Q: If I’m already retired, should I move my portfolio to cash?

A: No, most retirees need a balance of stocks and fixed income so that their savings can keep up with inflation and hopefully grow. However, if you need money for expenses in the next year, you should keep that in liquid assets like cash. And money for any other large expenses within the next five years should be in more conservative investments.

Cash needed for near-term expenses should never be in risky investments like stocks, regardless of the market environment. Generally, investments should be used for long-term goals like retirement because you have time to ride out market dips.

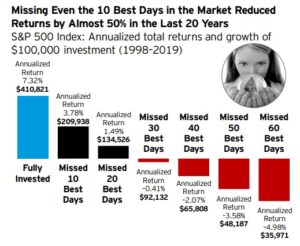

Going to all cash means that you will lock in any losses and prevent yourself from taking advantage of gains on days the markets go up. As this graph from Invesco shows, it seriously hurts your portfolio to miss out on those days when the market is up big:

Q: Is the stock market going to close?

A: Not likely, even though it’s happened before.

Treasury Secretary Steven Mnuchin said on March 17 that Wall Street and the White House are committed to keeping financial markets operating, even if it means reducing hours at some point. The SEC has made the same point. So, it’s possible hours may be reduced to curb some of the extreme volatility we’ve seen, but markets will probably stay open.

The New York Stock Exchange has rarely shut down outright in the nearly 230 years since its inception. It didn’t close during the Spanish Flu pandemic of 1918-1919, in the wake of the 1929 stock market crash or throughout the Great Depression and World War II. It did close during World War I and after 9/11. Today, it is capable of all-electronic operations, if necessary.

Q: Are my taxes still due on April 15?

A: Per an announcement by the Treasury Department, Tax Day has been moved from April 15 to July 15. Check with the relevant authorities in your area for state deadlines.

Q: Does the market’s recent double-digit drop mean a recession?

A: First, a little bit of history here: In 1987, the S&P 500 dropped 22% in one day–the infamous Black Monday crash. It was the market’s largest single-day point loss ever. That bear market lasted four months, and the U.S. economy surprisingly avoided a downtown. In today’s context, however, it’s likely that the effects of the measures being taken to combat coronavirus (e.g., social distancing and business closures) will cause the economy to contract significantly. The question is for how long.

Bottom line: The United States, the world’s biggest economy, is likely to have a recession this year. But if you’re an investor for the long-term, that should not affect your financial plan.

Q: My account statement was looking good in February. What should I expect this month?

A: The S&P 500 rose almost 29% over the course of 2019, good for the second-best year of the bull market. It took a little under four weeks to fall apart.

It’s important to remember, however, that as an Azzad client, you usually have an assortment of investments across several different asset classes, which means that your return will differ from what you see in the headlines. You do not own the S&P 500 or the Dow Jones Industrial Average. Your return is unique to your investment mix, which should be decided in consultation with an Azzad advisor. If you’ve already had that conversation–and you have a financial plan–then congratulations, you’re better prepared than many folks out there. And you don’t need to focus on daily market moves reported in the financial media. Trust in the process and plan. We’ve seen drastic ups and downs before. And we got through those, too. The people best equipped for those swings were those who remained calm and let the plan do its job.

Last updated 4/27/20; 5:50 p.m. ET

Market Outlook » Frequently Asked Questions: Coronavirus and Markets

Frequently Asked Questions: Coronavirus and Markets

In order to help clients navigate the extreme market volatility related to the coronavirus pandemic, we’ve put together the list of FAQs below. Check back often as this list will be updated. For more information and assistance, please contact your Azzad advisor at 888.86.AZZAD.

We will continue to monitor developments of COVID-19 and its impacts as information becomes available. We advise clients to stay patient and stick to their strategic asset allocation. Thank you for your continued trust and investment.

Q: What options are available to small business owners who want to retain their employees but need temporary help?

A: Many of our clients are small business owners, and some are searching for answers in this difficult time. Current economic conditions have adversely affected financial performance, and managers being forced to make some hard decisions.

First, try to avoid panicked moves, like layoffs, until you’ve considered options to help control costs. Even a temporary reduction in employees’ salaries is a better option than letting people go–both for you and them.

As for government aid, Congress is taking steps to alleviate the suffering of small businesses. There are three phases of coronavirus-related relief legislation, two of which have been signed into law by President Trump. The third is almost complete.

Phase 1: This initiative removed regulatory hurdles and authorized the SBA to provide an estimated $7 billion in low-interest disaster loans to small businesses. To enhance the process, the legislation provides $20 million to cover SBA expenses in this effort.

Phase 2: On March 18, President Trump signed H.R. 6201, the Families First Coronavirus Response Act. In addition to paid leave and food assistance to individuals, the measure provides tax credits to employers to offset the costs of providing emergency paid leave, and require insurers, Medicare, Medicaid and other federal health programs to fully cover testing and related services for the virus.

This law includes a provision that allows the Secretary of Labor to exempt small businesses with fewer than 50 employees from the paid leave requirements.

Phase 3: Congress agreed to and passed an additional $2.2 trillion economic stimulus package called the Coronavirus Aid, Relief and Economic Security (CARES) Act. It includes $367 billion for small businesses, among other provisions. It was signed into law by President Trump on March 27.

Phase 4: On April 24, President Trump signed the nearly $500 billion “Phase 3.5” emergency interim coronavirus relief package into law, replenishing the fund for small businesses and adding billions of dollars in aid to hospitals across the country amid the COVID-19 pandemic.

The Paycheck Protection Program (PPP) and Health Care Enhancement Act provides an additional $310 billion to fund the PPP, as well as $60 billion for the Small Business Administration’s (SBA) Economic Injury Disaster Loan program, $75 billion for hospitals and health care providers, and $25 billion to expand COVID-19 testing.

Watch our webinar on the provisions for small businesses in the CARES Act here.

Q: I am considering laying off some of my employees. Should I?

A: Many employers are enacting cost-cutting measures such as laying off employees and cutting hours. Although you’re in the best position to know what you can and cannot afford, we highly recommend that you leave laying off employees as a last resort. Employers who are able to navigate the economic effects of this crisis in a compassionate way will create more value for their businesses in the long run and will emerge out of this pandemic stronger than ever. By most estimates, this pandemic will be over in a few months. When the dust settles, your former employee(s) may not be available for rehiring. You’ll have to hire and train new employees which can be very expensive (some surveys estimate it to cost around 30% of that employee’s first year’s salary, depending on the position and location) and will most likely undermine your company’s profitability.

So, before laying off a single employee, we recommend you consider the following measures:

Communicate honestly with your employees. Your employees are likely feeling anxious about their jobs. Instead of forcing them to second-guess what may be in store for them, be very open about the financial health of your business and what goals you will prioritize. These goals won’t be the same for every business and you shouldn’t make empty promises or confusing statements. Instead, communicate your new priorities such as “our goal is to save jobs while meeting our loan obligations”.

We’re all in this together. Share your pain. Temporarily cutting your employees’ salaries to save job losses could be a feasible option for some businesses. However, as the boss, remember that you are your company’s leader so it is vital that you lead by example. That means forgoing your salary or taking the largest pay cut. If you decide to halt bonuses, make sure it’s across the board, beginning with yourself.

Crowdsource ideas from your employees. By asking your employees for ideas on what the company should do, you’ll have stronger buy-in for the initiatives you eventually prioritize. Many employers resist asking their employees for their ideas because they fear they’ll be resentful when their ideas aren’t implemented. In our experience, employees will not only appreciate this openness, but they are likely to also work on your behalf to persuade any disgruntled co-workers. Just make sure to stay in control of this process by articulating that you intend to prioritize initiatives with lower risk profiles, proven positive impact on cash flow, and a higher chance of saving jobs.

Consider all your options for reducing costs. Consider less conventional options such as moving your business to a shorter work-week, moving some employees to part time or giving unpaid leave to others. If you’ve communicated your intentions to your staff, namely that you’re trying to avoid laying employees off, you’ll discover they’re more likely to accept making certain temporary sacrifices.

We understand that being the leader of your company during these turbulent times can be challenging. If you act too quickly and lay off your employees, you may discover that you overreacted. If you act too slowly, your business may suffer. However, if you lead with compassion and empathy, you will touch the lives of your employees in an extraordinary way and come out of this crisis stronger than before.

Q: What are some key considerations and actions that small business employers can take during this pandemic?

A: Employers are navigating in uncharted territory, and although every business is unique, there are some key actions every employer may want to consider implementing during this pandemic.

First, to maintain the health and wellness of your employees, it’s vital that you try your utmost to reduce potential transmission among your staff. You can accomplish this with preventive wellness practices such as washing hands and disinfecting work surfaces. Make sure you’re regularly cleaning your office facilities with bleach or alcohol-based wipes. Also, actively encourage any sick employees and contractors to stay home. If you do not have a sick leave policy, now is the time to consider implementing one. Think about employees who may be at higher risk to COVID-19, such as those over the age of 60 and those with chronic medical conditions. If your business allows it, consider allowing these employees to work remotely.

The next key consideration for many employers will be to ensure that you have a thorough business continuity plan. Your plan should consider flexible or remote work practices. Although we recognize that not every business will lend itself to remote work, there may be certain job functions that can be accomplished remotely. Modern technology has enabled even health care professionals to consult with their patients by using HIPAA compliant video-conferencing tools. This concept, referred to as telemedicine, makes healthcare more accessible, cost-effective and increases patient engagement. For other businesses, remote work may be as simple as subscribing to a web or video conferencing service and ensuring you have enough bandwidth to continue operations. If remote work is not viable for your business, consider whether you can implement flexible work hours or staggered shifts to help increase the physical distance among employees.

Finally, you’ll need to think about how your business will respond in the event that this illness touches your operations directly. Employees who become ill after arriving to work (and show symptoms such as fever, cough or shortness of breath) should be immediately separated from other employees and sent home. Be aware that you’re still obligated to maintain that employee’s confidentiality as required by the Americans with Disabilities Act (ADA), but you should inform fellow employees of their possible exposure to COVID-19. In addition, cross-training your key employees or making sure that more than one employee can carry the functions of another is vital for the continuation of your business.

Implementing a sick leave policy, developing your business continuity plan and cross training your key employees are best business practices. It is not too late to start implementing these practices for your small business.

Q: I am worried about being cash strapped in a few months. What should I do?

First of all, you’re not alone. A recent Federal Reserve study, showed that 40% of Americans couldn’t even afford a $400 emergency repair.

It’s okay to sell some of your investments to raise immediate cash. We often preach the virtues of staying the course, but it’s reasonable to have liquid assets on hand. Sometimes you need to change your mentality to a cash preservation mode. In those situations, it’s good to have a “bucket approach” to your investments.

The idea behind the bucket approach is to divide your portfolio into several different buckets, with transfers between those buckets carefully structured. The first bucket would contain enough cash and liquid assets to meet immediate expenses (say, within the next six to twelve months), with another bucket containing slightly riskier assets like fixed income for needs anticipated within the next five years. The third bucket would be for longer-term investing, allocated specifically to stocks. That first bucket would be replenished only when riskier assets perform well. Bucket approaches have great intuitive appeal, since they insulate investors from concern about the impact a bear market might have on their immediate expenses.

I feel like I should do something with my portfolio. What are some practical steps I can take now that markets are lower than they were to start the year?

It’s true that nothing eases anxiety more than taking some proactive steps. And while you shouldn’t tinker with your portfolio if you’ve already got a plan in place, there are some smart ways to respond to today’s lower market. Here are three things to think about:

Tax Loss Harvesting

With global equities having declined 20 percent in the first quarter, investors may now have positions in taxable accounts with unrealized losses. In such instances, an investor may want to consider harvesting the loss or selling securities that have declined below their initial purchase price. In doing so, a realized loss is produced for tax purposes. Tax-loss harvesting may help investors reduce their current tax liabilities for taxable accounts.

Realized losses can offset realized gains. To the extent realized losses exceed realized gains in a given tax year, up to $3,000 of losses can be applied against ordinary income with any excess producing a loss carryforward to be used in future tax years. There are several considerations to be aware of prior to harvesting losses for tax purposes, so be sure to understand the pros and cons before selling.

(Note: Azzad Asset Management does not provide tax advice. Clients should consult with their tax advisors regarding the tax consequences of engaging in tax-loss harvesting. Tax-loss harvesting may create potential capital gains and wash sales.)

Rebalancing

This is the process of periodically comparing your original asset allocation to your current portfolio, and if the holdings vary more than a maximum threshold (say 5%), then it may be time to rebalance. When you rebalance, you sell a portion of your portfolio that was outperforming and buy more of the underperforming assets to bring the investment mix back the way you originally designed it. By rebalancing your portfolio, you essentially reduce your risk relative to your target asset allocation.

A word of caution: trading during these very volatile days may not be wise for every investor. You should balance your investment plan with current market conditions, your risk tolerance, and time horizon (including potential tax consequences).

For example: March 2020 has entered the history books as the most volatile month in stock market history. Through month-end, the average daily swing for the S&P 500 was 5.75%. On March 12th, the S&P 500 posted a -9.51% loss only to close +9.29% the very next day. If you had rebalanced after the big down day, you could be off target the very next day. Therefore, it is imperative that you consult with your advisor.

Charitable Giving

Ordinarily, an investor with long-term appreciated securities would be better served by gifting such securities rather than cash. However, this general guideline changes a bit given 1) the extent of the recent market decline (stocks were more valuable as of late 2019) and 2) tax changes associated with the recently passed Coronavirus Aid, Relief and Economic Security Act (“CARES Act”).

The CARES Act included a provision removing the adjusted gross income (AGI) limitation for cash contributions made in 2020 to public charities (private foundations, supporting organizations and donor-advised funds are excluded). As such, taxpayers can elect to deduct up to 100 percent of adjusted gross income after factoring in other charitable contributions otherwise subject to AGI limitations. In comparison, the charitable deduction for long-term appreciated securities is limited to 30 percent of AGI for gifts to public charities and 20 percent of AGI for gifts to private foundations. As a result, some taxpayers may find a greater tax benefit in making 2020 charitable gifts through cash rather than securities.

I’ve heard that now may be the time to do a Roth IRA conversion. Is that true?

Individuals with Traditional IRA or 401(k) assets may consider converting all or a portion of their balances to a Roth IRA, as the market selloff has reduced account balances. Roth IRAs have very favorable tax treatment as the account grows tax-deferred, qualified distributions are tax-free and there are no required minimum distributions for the original account owner.

Individuals should recognize that converting a Traditional IRA or 401(k) to a Roth IRA is a taxable event (taxed at ordinary income rates) thus, there are numerous variables to consider including: Also, keep in mind that, beginning 2018, a recharacterization of Roth IRA conversions was repealed. That means you can’t change your mind after you’ve converted your IRA or 401(K) plan into a Roth. As such, there’s a greater emphasis on planning so we recommend you consult with your tax advisor prior to doing any conversions.

Also, keep in mind that, beginning 2018, a recharacterization of Roth IRA conversions was repealed. That means you can’t change your mind after you’ve converted your IRA or 401(K) plan into a Roth. As such, there’s a greater emphasis on planning so we recommend you consult with your tax advisor prior to doing any conversions.

Q: How should I react to these up and down days?

A: First of all, don’t panic. Of course, it’s easy to say, but certainly a lot harder to do. However, panic is not a strategy. It’s harmful to your portfolio, not to mention your physical well-being. Panic intensifies the negative and makes your thinking more biased toward the downside. You’re more likely to predict negative outcomes and to looking for the quickest, easiest way to resolve uncertainty. You also tend to put too much focus on what others are doing, discounting the objective information right in front of you. Too often that means selling stocks when you shouldn’t. To make sure your decisions stand the test of time, take small steps, nothing drastic. And do things in consultation with your Azzad advisor.

Q: What’s going to happen to the economy?

A: The economy is going to take a meaningful hit through at least mid-2020 and a recession is much more likely than it was several weeks ago. Certain sectors of the economy will be hit particularly hard, but virtually everything will be adversely impacted. However, it’s important to note that markets often rally well before buds of optimism start to grow.

The optimistic scenario for this moment is a sharp but brief economic contraction. Numerous forecasters are now projecting a tumble in economic output, starting in the first or second quarter, followed by a rebound. Not all economic activity is lost. Think of those Clorox wipes people have been buying and all those Amazon orders people have been making. Amazon is even raising wages and increasing hiring right now.

The pessimistic scenario is not as rosy. Human psychology risks creating a cycle of plummeting demand from consumers and businesses, a downward spiral called a “demand shock” that monetary or fiscal policy may be unable to halt easily. Corporations are going to need to unload debt, and the federal government will need to creative with solutions. It’s doable, but it won’t be easy.

Q: Will these wild market ups and downs ever stop?

A: Market volatility is going to remain extremely high for the foreseeable future. However, this too will pass. In the meantime, we need to be ready to face the challenges that will unfold over the coming weeks and try not to get caught up in the emotional swings that can accompany this kind of market volatility. We’ve faced very difficult times in the markets and will face them again in the future. Stay calm and keep your wits about you. And as this chart illustrates, that volatility can be your friend when markets move up. You never know when it’s going to happen, but if the past is any indication, it could be just around the corner. If you ride out those ups and downs, the market may reward you handsomely:

Source: Bloomberg

Q: Why are stocks so much lower all of a sudden?

A: In part, the market drop reflects concern about profits. When the economy shrinks even a little, corporate profits tend to shrink a lot. Businesses’ fixed expenses don’t drop as fast as their revenue. So a relatively small decrease in gross domestic product might mean a big drop in future corporate earnings.

Everyone may recognize that buyers are paying less than the assets are worth in the long term. But in moments like these, that long-term value is not driving the price. Eventually, investors will get a better feel for where we’re headed and swoop in to scoop up bargains. That can, however, take some time.

Over years and decades, stock prices are related to their expected returns in the form of dividends or capital gains. That’s why you shouldn’t panic and sell right now. But over short periods of crisis, when everyone is just trying to figure out what might happen next, markets aren’t efficient in that narrow sense. They can be just as irrational and volatile as we are. So remain patient.

Q: If I’m already retired, should I move my portfolio to cash?

A: No, most retirees need a balance of stocks and fixed income so that their savings can keep up with inflation and hopefully grow. However, if you need money for expenses in the next year, you should keep that in liquid assets like cash. And money for any other large expenses within the next five years should be in more conservative investments.

Cash needed for near-term expenses should never be in risky investments like stocks, regardless of the market environment. Generally, investments should be used for long-term goals like retirement because you have time to ride out market dips.

Going to all cash means that you will lock in any losses and prevent yourself from taking advantage of gains on days the markets go up. As this graph from Invesco shows, it seriously hurts your portfolio to miss out on those days when the market is up big:

Q: Is the stock market going to close?

A: Not likely, even though it’s happened before.

Treasury Secretary Steven Mnuchin said on March 17 that Wall Street and the White House are committed to keeping financial markets operating, even if it means reducing hours at some point. The SEC has made the same point. So, it’s possible hours may be reduced to curb some of the extreme volatility we’ve seen, but markets will probably stay open.

The New York Stock Exchange has rarely shut down outright in the nearly 230 years since its inception. It didn’t close during the Spanish Flu pandemic of 1918-1919, in the wake of the 1929 stock market crash or throughout the Great Depression and World War II. It did close during World War I and after 9/11. Today, it is capable of all-electronic operations, if necessary.

Q: Are my taxes still due on April 15?

A: Per an announcement by the Treasury Department, Tax Day has been moved from April 15 to July 15. Check with the relevant authorities in your area for state deadlines.

Q: Does the market’s recent double-digit drop mean a recession?

A: First, a little bit of history here: In 1987, the S&P 500 dropped 22% in one day–the infamous Black Monday crash. It was the market’s largest single-day point loss ever. That bear market lasted four months, and the U.S. economy surprisingly avoided a downtown. In today’s context, however, it’s likely that the effects of the measures being taken to combat coronavirus (e.g., social distancing and business closures) will cause the economy to contract significantly. The question is for how long.

Bottom line: The United States, the world’s biggest economy, is likely to have a recession this year. But if you’re an investor for the long-term, that should not affect your financial plan.

Q: My account statement was looking good in February. What should I expect this month?

A: The S&P 500 rose almost 29% over the course of 2019, good for the second-best year of the bull market. It took a little under four weeks to fall apart.

It’s important to remember, however, that as an Azzad client, you usually have an assortment of investments across several different asset classes, which means that your return will differ from what you see in the headlines. You do not own the S&P 500 or the Dow Jones Industrial Average. Your return is unique to your investment mix, which should be decided in consultation with an Azzad advisor. If you’ve already had that conversation–and you have a financial plan–then congratulations, you’re better prepared than many folks out there. And you don’t need to focus on daily market moves reported in the financial media. Trust in the process and plan. We’ve seen drastic ups and downs before. And we got through those, too. The people best equipped for those swings were those who remained calm and let the plan do its job.

Last updated 4/27/20; 5:50 p.m. ET

Let Us Help You Achieve Your Financial Goals Today

Quick Links

Lessons I Learned While Training for a Marathon—and How They Apply to Building Financial Security

Tax Planning for Self-Employed Muslim Business Owners: What you need to know

Financial Transparency in Marriage: An Islamic Perspective

Is a Recession on the Horizon? What Economic Indicators Are Telling Us

Why We Follow GIPS® and What It Means for You

Subscribe to the Blog

Insights & Financial Education