Would you be willing to give up 40% per year in investment return? While most people would balk at the thought of losing that much money, they may be doing so unknowingly if they’re paying both advisor fees and mutual fund fees.

A no-frills investment advisor would likely charge around 1% per year (this figure may be higher or lower depending on the size of your account). But about one percent is often the sticker price they present to prospective clients when making the pitch to manage their money.

But if your advisor is using mutual funds, then there are two investment costs that determine the real cost of your advisor: the advisor fee AND mutual fund expenses.

Advisors don’t always tell prospective clients about mutual fund expenses, which can add another 1-1.5% percent. This would bring the total cost of investing with that advisor to a whopping 2-2.5%. Mutual fund expenses are embedded in the cost of the fund, so you might not even know about it unless you read each fund’s prospectus and the advisor’s disclosure brochure for any other fees you may pay. It’s always a good idea to ask what the expense ratio (that’s the fee) for a mutual fund is.

Using averages for mutual fund expenses and advisor fees as well as expected returns for a typical 60/40 stock and fixed income balanced portfolio, an investor who pays mutual fund fees on top of advisor fees could lose up to 40% of expected gains to expenses.

But there are ways to lower those fees. The best way is to look for an advisor who uses lower-cost managed accounts, which are baskets of stocks that offer you direct ownership of shares. Managed accounts, sometimes called separately managed accounts or SMAs, are more cost-effective and give you greater control over tax loss harvesting. That’s what we use at Azzad. (We also use the Azzad Mutual Funds in our SMAs, but no advisor fee is charged on the portion of a client’s account that’s invested in the funds. We don’t stack advisor fees on top of mutual fund fees.)

See: SMAs versus mutual funds: Which should you use for your financial goals?

Giving up 40% per year to access the markets should catch any investor’s attention. Of course, no investment is completely free of management expenses, and financial advisors should be paid for the added services they offer clients.

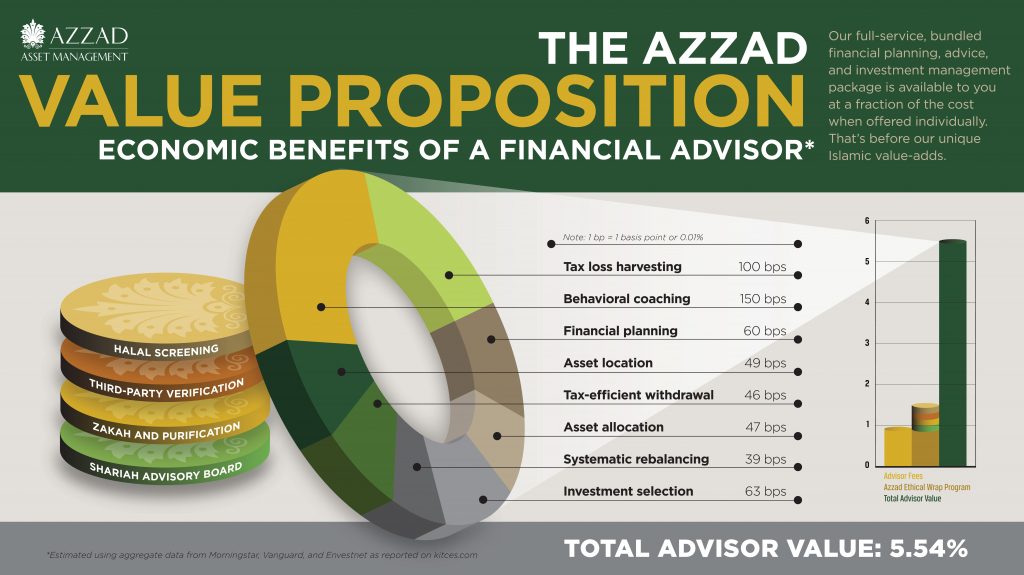

For instance, at Azzad, our standard fee starts around 1.75%, and the services that fee represents include active management, ethical investment restrictions, financial advice, rebalancing, and asset allocation, to name a few. They’re summarized in the graphic below, which in addition to showing you the value of using a financial advisor, also explains how we stack up against the competition.

Read more about our services and fees in our firm’s Part 2A of Form ADV or Wrap Brochure.

Consider using this when you’re examining fees and what services you’re getting for the price:

Whether it’s with a conventional advisor or a specialty firm like ours, be a smart shopper to make sure you’re not spending more than you need to on a financial advisor.