If at age 25 you deposit $100 a month into a mutual fund with an annualized return of 10% a year, you’ll have about $640,000 when you’re 65. You’ll have deposited a total of $48,000 of your own money. On the other hand, if you procrastinate and wait until you’re 40 to start saving, you’ll need to come up with another $142,000 out of your own pocket to have the same amount at age 65. That’s the power of compounding – the power of money making money for you.

Many investors think they can just make a small initial deposit and then market returns will make them rich. Here’s the reality: contributions matter more than investment returns when you’re building your portfolio. While it’s true that investment returns can help grow your wealth and protect it from inflation, they alone don’t have the power to make you rich.

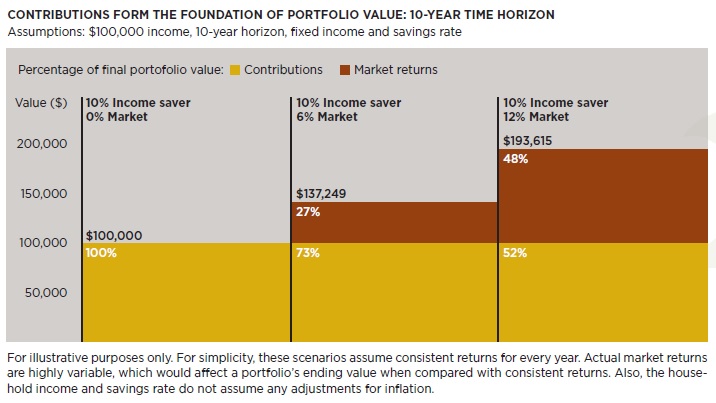

The chart below illustrates three scenarios for an investor earning $100,000 annually and investing 10% of his income over a decade. In a moderate portfolio that earns 6% annually, illustrated in the middle column, contributions account for 73% of the portfolio! Even in a bull market that earns 12% annually, contributions matter more than returns. In this case, illustrated in the third column, contributions represent 52% of the portfolio.

The key to reaching your financial goals is by regularly funding your account. Call us to find out how you can set up an automatic investment plan in your account.