Do you know how much you’re worth financially? Knowing your net worth can help you to better plan for your future and set savings goals.

To calculate your net worth, add up the value of everything you own and subtract from that amount everything you owe. In other words, your assets minus your debt equals your net worth.

It’s not complicated, although it may take you some time to gather all the information you’ll need to determine a final figure.

Try the online net worth calculator at Investopedia.com. It’s easy to navigate and you can personalize the information by adding specific assets and liabilities.

According to the site, “alculating your net worth helps you figure out where you are financially at this point in time. Expressed as a dollar amount, your net worth represents your financial health and is essentially the result of everything you have earned and spent up until now. While taking the time to calculate your net worth one time is helpful, what is really beneficial is to make this calculation on a regular basis so you can see trends in your overall financial health.”

Of course, you want to see a positive number on your net worth statement. If you assets are greater than your debt, then know that your financial situation is great compared to many people. If it they aren’t, then this is your wake-up call.

It’s also helpful for people who have high salaries and think that automatically means they’re in good financial shape. They measure their financial success by what they earn. But if you’re spending all your money, accumulating assets that don’t appreciate, or racking up debt, you’re not building true wealth. You can have a high salary and still be broke.

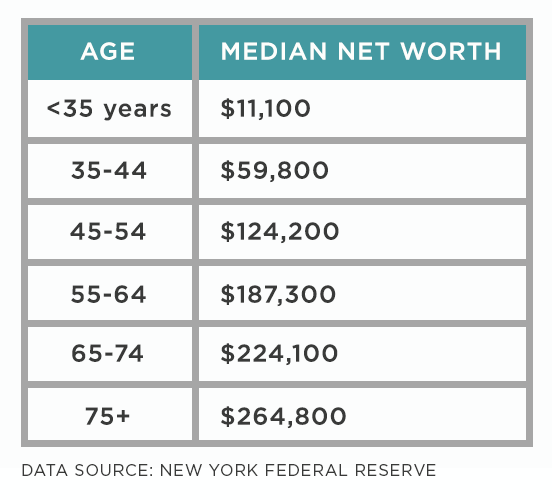

Want know how your net worth compares to others in your age range?

Here’s the table:

And if you’re not happy with your current net worth, then take that as encouragement to do something to change it. Save and invest more, or consider reducing your debt. Our Azzad financial advisors can help you with these types of financial planning moves. We’re here to help.