Legendary investor Warren Buffett is famous for his long-term perspective. He has said that he likes to make investments he would be comfortable holding even if the market shut down for 10 years.

Investing with an eye toward the long term is particularly important with stocks. Historically, equities have typically outperformed bonds, cash, and inflation, though past performance is no guarantee of future results and those returns also have involved higher volatility.

It can be challenging to have Buffett-like patience during periods such as 2000-2002, when the stock market fell for 3 years in a row, or 2008, which was the worst year for the Standard & Poor’s 500 index since the Depression era. Times like those can frazzle the nerves of any investor, even the pros. With stocks, having an investing strategy is only half the battle; the other half is being able to stick to it.

Just what is long term?

Your own definition of “long term” is most important, and will depend in part on your individual financial goals and when you want to achieve them. A 70-year-old retiree may have a shorter “long term” than a 30-year-old who is saving for retirement.

Your strategy should take into account that the market will not go in one direction forever — either up or down.

The benefits of patience

Trying to second-guess the market can be challenging at best; even professionals often have trouble. According to “Behavioral Patterns and Pitfalls of U.S. Investors,” a 2010 Library of Congress report prepared for the Securities and Exchange Commission, excessive trading often causes investors to underperform the market.

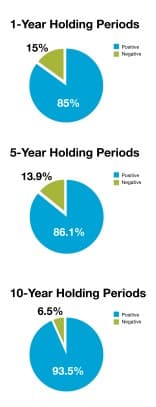

Though past performance is no guarantee of future results, the odds of achieving a positive return in the stock market have been much higher over a 5- or 10-year period than for a single year.

The Power of Time

Refinitiv, 2022. S&P 500 composite total return for the period December 31, 1981, to December 31, 2021. Ranges consider the 40 one-year periods, 36 five-year periods, and 31 ten-year periods from 1982 to 2021.

Another study, “Stock Market Extremes and Portfolio Performance 1926-2004,” initially done by the University of Michigan in 1994 and updated in 2005, showed that a handful of months or days account for most market gains and losses. The return dropped dramatically on a portfolio that was out of the stock market entirely on the 90 best trading days in history. Returns also improved just as dramatically by avoiding the market’s 90 worst days; the problem, of course, is being able to forecast which days those will be. Even if you’re able to avoid losses by being out of the market, will you know when to get back in? The answer is you won’t.

So, stay the course and position yourself to take advantage of the market’s long term trends.