Charitable Lead Trust (CLT)

A charitable lead trust allows you to support a charitable cause while producing tax savings for yourself and helping you achieve financial goals.

A CLT can help you give to charity while

- Reducing your income taxes

- Reducing estate or gift taxes

- Transferring assets in a tax-efficient way

What is a CLT?

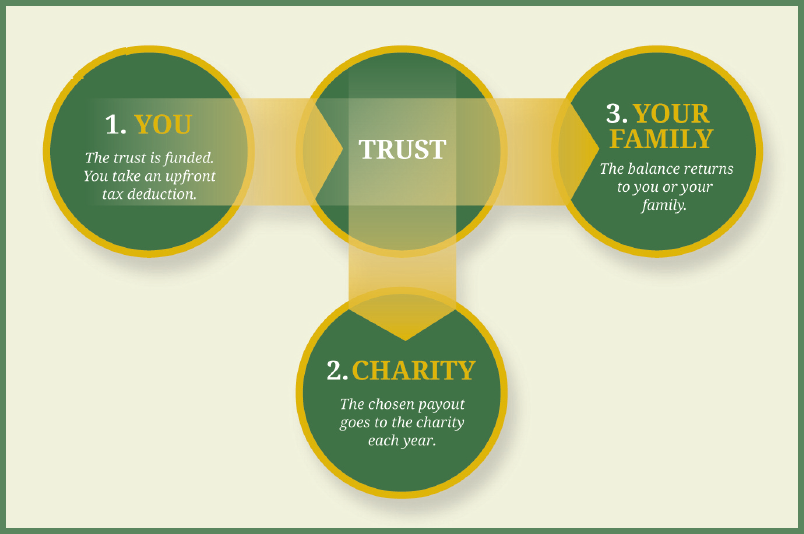

A trust is a legal entity in which assets are held and managed for a set period of time. With a charitable lead trust, a percentage you set is donated to a charity each year. At the end of the trust term, the balance returns to you or your family.

When establishing a CLT, you choose:

- The amount you will fund the trust

- How long you want the trust to last

- The charitable beneficiary (which tax-exempt charity you want the trust to benefit, e.g., a nonprofit, university, hospital, etc.)

- The charitable payout (the percentage you want the trust to give to the nonprofit each year)

- The non-charitable beneficiary (the person who will receive the balance of the trust when the term ends, usually yourself or a family member)

What are the benefits of a CLT?

It ensures long-term support of your chosen charity

If assets in the trust are invested they can grow during the trust term, thus potentially increasing the total amount given to charity (and leaving a balance at the end of the trust). A CLT allows the charity to count on regular donations during the term of the trust.

It’s a smarter way to give, with greater tax benefits

When a CLT is established, the IRS assigns a value to the total amount expected to go to the charity. You can take an upfront income tax deduction based on this value.

It can be used as a tool to transfer wealth while protecting your estate from transfer taxes

By listing a loved one as the non-charitable beneficiary, you can transfer property based on the value when the trust is funded rather than the value at the trust’s end. This technique can help you avoid paying more in estate and gift taxes.

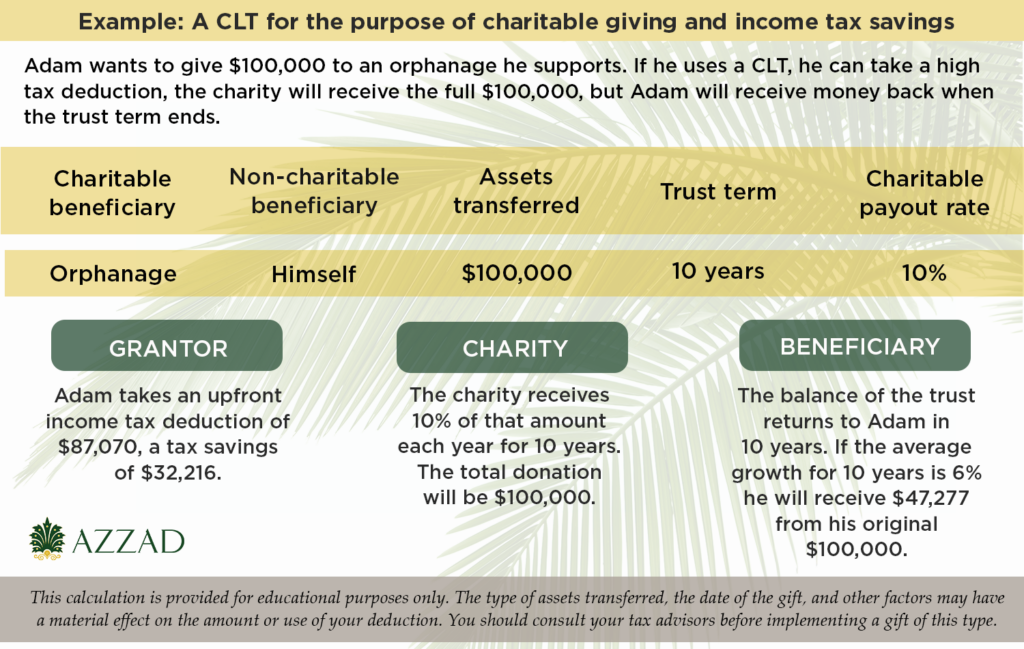

Example: A CLT for Charitable Giving and Income Tax Savings

Let’s look at a hypothetical example. Please note that these numbers are used for simplicity and do not reflect real portfolios.

Adam wants to make a sizeable donation to a charity he supports. If he uses a grantor charitable lead annuity trust he can take a high income tax deduction on this donation, but he will also receive money at the end of the trust term.

Adam creates a CLT and funds it will $100,000. He sets a charitable payout of 10% per year. With an assumed annual growth rate of 6%, he can take an immediate income tax charitable deduction of $87,070. If he is taxed at 37%, he will realize tax savings of $32,216.

Over the next 10 years, the CLT will distribute a total of $100,000 to his chosen charity, providing a regular donation the charity can count on.

And at the end of the 10 years, Adam (the trust’s non-charitable beneficiary) will receive an estimated $47,277, the remainder of the trust.

Be aware that:

- The trust represents an irrevocable gift to your chosen charity and non-charitable beneficiary. You should only undertake a CLT if you will not need the funds in the trust for the entire term and if you are confident that you want to give to the chosen beneficiaries. Note: When setting up a CLT, you can add a provision that would allow you to change the charity during the trust term if you choose to.

- If you designate yourself as the non-charitable beneficiary, you will have to pay income tax on the trust’s growth each year.

Setting up a CLT with Azzad

Azzad can help you design a CLT that will fit your financial goals and we can steer the team of professionals needed to establish your trust, including an attorney and an administrator. We work efficiently with those professionals, helping you save time and setup costs.

Most importantly, Azzad’s expertise in halal investing will give you peace of mind that the money in your trust is managed in a halal way.

Contact us if you’d like to learn more about charitable lead trusts or other wealth management strategies that could benefit you.

This information has been prepared solely for informational purposes and is not intended to provide or should not be relied upon for legal, tax, or investment advice. We recommend you consult with your tax professional about your particular situation before starting a CLT or any other charitable account. Factual information has been taken from sources believed to be reliable, but its accuracy and completeness cannot be guaranteed. Investments are not FDIC insured nor are they deposits of or guaranteed by a bank or any other entity, so you may lose money.