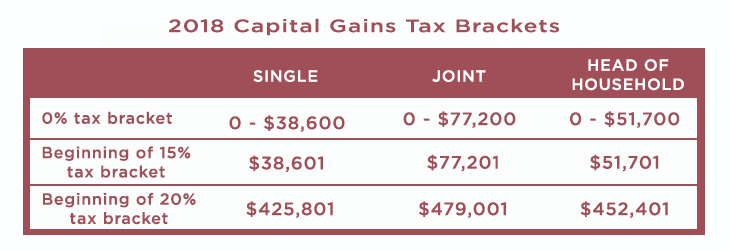

Did you know that you or your heirs might be eligible for a 0% rate on long-term capital gains and dividends? The Tax Cuts and Jobs Act (TCJA) signed into law late last year kept the three federal income tax rates on long-term gains (0%, 15%, and 20%). But unlike the old rules, these rates are no longer tied to the ordinary income rate brackets.

What’s more, many individual taxpayers may still qualify for the 0% federal income tax rate on long-term capital gains and dividends. Before you object that your income is too high to benefit, remember that you may have children, grandchildren, or other loved ones who may still be able to take advantage. Here’s what you need to know.

Help loved ones to cash in on the 0% rate

While your income may be too high to benefit from the 0% rate, you may have relatives who qualify. If so, consider giving them some appreciated stock or mutual fund shares that they can then sell and then pay 0% federal income tax on the resulting long-term capital gains. Gains will be long-term as long as your ownership period plus your gift recipient’s ownership period (before the recipient sells) equals at least a year and a day.

Giving away stocks that pay dividends is another good idea. As long as the dividends fall within your gift recipient’s 0% rate bracket, they may be federal-income-tax-free.

After 2018, these brackets will be indexed for inflation.

Before the new law, individual taxpayers faced three federal income tax rates on long-term capital gains (LTCGs) and qualified dividends: 0%, 15%, and 20%. The rate brackets were tied to the ordinary income rate brackets.

• If the LTCGs and/or dividends fell within the 10% or 15% ordinary income brackets, the tax rate was 0%.

• If the LTCGs and/or dividends fell within the 25%, 28%, 33%, or 35% ordinary income brackets, they were taxed at 15%.

• If they fell within the maximum 39.6% ordinary income bracket, they were taxed at the maximum 20% rate.

The bottom line

While the 0% tax rate may seem too good to be true, it is in fact true. And it still exists under the TCJA. So, if you have children or other relatives who are still in their wealth-accumulating years, they could benefit. Remember, this rate applies only to long-term capital gains and dividends that accumulate in taxable investment accounts.

This information should not be construed as tax advice. Always consult your tax professional regarding your specific tax situation.