The United Kingdom’s exit from the European Union, or “Brexit,” became official yesterday with 52% of the vote. As expected, markets are reeling from the resulting uncertainty. Even though there is no precedent for what’s to come, we know a couple of things for sure.

First, it will take two years to formally withdraw from the EU, which means that investors get to fret over this decision for many months to come. Second, and more importantly for US investors, American companies have very little exposure to companies on the other side of the Atlantic.

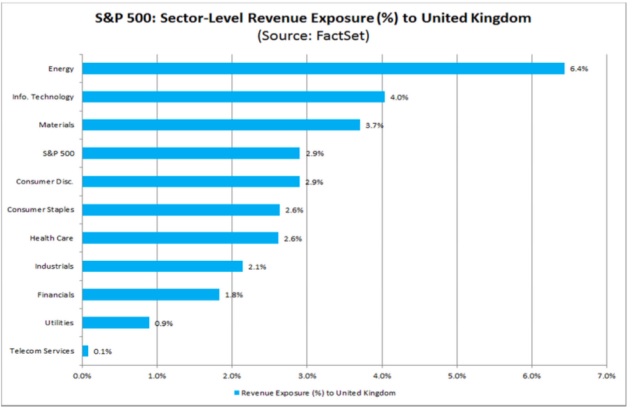

According to FactSet, the S&P 500, an index of larger US businesses, has a mere 2.9% sales exposure to the UK. Even the most exposed sector, energy, derives only 6.4% of sales from the UK. This is an important point to remember as you wade through all of the articles outlining the political implications of the UK withdrawal.

Although much ink has been spilled in an effort to explain the political consequences, not nearly as much attention has been given to Brexit’s impact on markets longer term.

This chart shows the exposure of the S&P 500 to the UK by business sector:

Additionally, according to a recent Citigroup report, Europe directly accounts for just 9% of sales for the companies that make up the S&P 500. That, along with the fact that most of those sales come from stable categories like food, beverages, and pharmaceuticals, means that the British decision to leave the EU is not likely to have a dramatic impact on those companies’ bottom lines.

Does this mean there’s nothing to worry about? No, the Brexit decision certainly bears watching, and we are monitoring the situation closely at Azzad. But clients should understand that political risk is a different category of concern, one that does not necessarily indicate a prolonged downward spiral for equities.

It’s also important to distinguish between short term and long term. In the short term, perhaps over the next few days or even weeks, there will certainly be dislocations stemming from this negative shock. Long term, emotional investing is likely to subside and cooler heads to prevail.

The bigger picture

There’s an old saying that goes: “Fool me once, shame on you. Fool me twice, shame on me.”

Whether it’s the slower-growth Chinese economy, Greek insolvency, or European banks, external shocks to US markets and the economy have become par for the course. What we have seen from each of these events, however, is that beyond the initial volatility, there has been relatively minor damage to the overall prospects for steady, albeit slow, global growth.

As sure as markets turned on fears about those events, investors will doubtless get a case of the jitters as we enter the unknown territory of a post-Brexit world. We expect, however, that markets will recover in similar fashion, presenting opportunities for patient investors.

As during those previous events, markets are currently being driven by emotion, rather than a substantial change in fundamentals. Although data have indicated problems with corporate earnings over the past several quarters, we have seen nothing to indicate a major blow to the United States. And all indications point to an accommodative Federal Reserve holding off on further interest rate hikes pending the outcome of what will be a long process for the UK to extricate itself from the EU. This is in addition to global central banks stepping in to provide liquidity and other measures to ensure market stability.

What to expect now

Investors should not be surprised to see more turbulence over the short term. But remember that volatility can be your friend. Without it, you couldn’t make money in the markets.

When you own stock in a company, you own part of a business. The value of that business does not fluctuate as wildly on a day-to-day basis as its stock price. This means that its market price at one particular time may not accurately reflect what your ownership stake in the business is worth. When stock prices are affected by outside forces that can temporarily drive down prices, you have an opportunity to pick up quality companies at a bargain. That’s where we come in. Our portfolio managers are focused on quality companies and quality returns—regardless of market environment.

We can expect to see more volatility as markets reprice and we adjust to the new face of Europe. If you’re in need of cash within the next few months, you should not be invested in stocks. Consider taking some risk off the table and reallocating to fixed income. (Sukuk appear to be relatively resilient in the wake of Brexit.) If you’re a longer-term investor, however, stay the course.

If you’re in it for the long term but still have trouble sleeping at night, we can talk about rebalancing your portfolio to get you back in line with your original asset allocation. And if you’ve got cash sitting on the sidelines, think about deploying it. As legendary investor Warren Buffett says, “Buy when there’s blood in the street.”

We’re here to help. If you would like to talk things over, give us a call at 888.86.AZZAD or email info@azzad.net. Thank you for your continued trust and investment.

Past performance cannot guarantee future results. No investment strategy can eliminate the risk of losses. Asset allocation, rebalancing and diversification are investment strategies used to help manage risk. They do not ensure a profit or protect against a loss.

Opinions expressed are those of the author or fund manager, are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Click here for Azzad Ethical Fund current top 10 holdings.

Past performance does not guarantee future results.

The Azzad Ethical Fund is non-diversified and may invest a larger percentage of its assets in fewer companies exposing it to more volatility and/or market risk than diversified funds. The Fund may not achieve its objective and/or could lose money on your investment in the Fund. Stock markets and investments in individual stocks can decline significantly in response to issuer, market, economic, political, regulatory, geographical, and other conditions. Investments in mid-cap companies can be more volatile than investments in larger companies. Investments in growth companies can be more sensitive to the company’s earnings and more volatile than the stock market in general. Because the portfolio may invest substantial amount of its asset in issuers located in a single country or in a limited number of countries, it may be more volatile that a portfolio that is more geographically diversified. See the prospectus for more details about risks.

Investments in smaller and medium sized companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a great risk of loss to principal and interest than higher rated securities.

The Azzad Wise Capital Fund is non-diversified with a high concentration of securities in the financial sector which can expose the Fund to more volatility and/or market risk than diversified funds. The Fund may not achieve its objective and/or could lose money on your investment in the Fund. The Fund mainly invests in securities issues by foreign entities which expose the Fund to country specific risks such as market, economic, political, regulatory, geographical, and other risks. The Fund intends to invest in certain instruments that may be illiquid. As a result, if the Fund receives large amount of redemptions, the Fund may be forced to sell such illiquid investments at a significant loss to be able to meet such redemption requests. See the prospectus for more details about risks.

Investing in a post-Brexit world

Investing in a post-Brexit world

The United Kingdom’s exit from the European Union, or “Brexit,” became official yesterday with 52% of the vote. As expected, markets are reeling from the resulting uncertainty. Even though there is no precedent for what’s to come, we know a couple of things for sure.

First, it will take two years to formally withdraw from the EU, which means that investors get to fret over this decision for many months to come. Second, and more importantly for US investors, American companies have very little exposure to companies on the other side of the Atlantic.

According to FactSet, the S&P 500, an index of larger US businesses, has a mere 2.9% sales exposure to the UK. Even the most exposed sector, energy, derives only 6.4% of sales from the UK. This is an important point to remember as you wade through all of the articles outlining the political implications of the UK withdrawal.

Although much ink has been spilled in an effort to explain the political consequences, not nearly as much attention has been given to Brexit’s impact on markets longer term.

This chart shows the exposure of the S&P 500 to the UK by business sector:

Additionally, according to a recent Citigroup report, Europe directly accounts for just 9% of sales for the companies that make up the S&P 500. That, along with the fact that most of those sales come from stable categories like food, beverages, and pharmaceuticals, means that the British decision to leave the EU is not likely to have a dramatic impact on those companies’ bottom lines.

Does this mean there’s nothing to worry about? No, the Brexit decision certainly bears watching, and we are monitoring the situation closely at Azzad. But clients should understand that political risk is a different category of concern, one that does not necessarily indicate a prolonged downward spiral for equities.

It’s also important to distinguish between short term and long term. In the short term, perhaps over the next few days or even weeks, there will certainly be dislocations stemming from this negative shock. Long term, emotional investing is likely to subside and cooler heads to prevail.

The bigger picture

There’s an old saying that goes: “Fool me once, shame on you. Fool me twice, shame on me.”

Whether it’s the slower-growth Chinese economy, Greek insolvency, or European banks, external shocks to US markets and the economy have become par for the course. What we have seen from each of these events, however, is that beyond the initial volatility, there has been relatively minor damage to the overall prospects for steady, albeit slow, global growth.

As sure as markets turned on fears about those events, investors will doubtless get a case of the jitters as we enter the unknown territory of a post-Brexit world. We expect, however, that markets will recover in similar fashion, presenting opportunities for patient investors.

As during those previous events, markets are currently being driven by emotion, rather than a substantial change in fundamentals. Although data have indicated problems with corporate earnings over the past several quarters, we have seen nothing to indicate a major blow to the United States. And all indications point to an accommodative Federal Reserve holding off on further interest rate hikes pending the outcome of what will be a long process for the UK to extricate itself from the EU. This is in addition to global central banks stepping in to provide liquidity and other measures to ensure market stability.

What to expect now

Investors should not be surprised to see more turbulence over the short term. But remember that volatility can be your friend. Without it, you couldn’t make money in the markets.

When you own stock in a company, you own part of a business. The value of that business does not fluctuate as wildly on a day-to-day basis as its stock price. This means that its market price at one particular time may not accurately reflect what your ownership stake in the business is worth. When stock prices are affected by outside forces that can temporarily drive down prices, you have an opportunity to pick up quality companies at a bargain. That’s where we come in. Our portfolio managers are focused on quality companies and quality returns—regardless of market environment.

We can expect to see more volatility as markets reprice and we adjust to the new face of Europe. If you’re in need of cash within the next few months, you should not be invested in stocks. Consider taking some risk off the table and reallocating to fixed income. (Sukuk appear to be relatively resilient in the wake of Brexit.) If you’re a longer-term investor, however, stay the course.

If you’re in it for the long term but still have trouble sleeping at night, we can talk about rebalancing your portfolio to get you back in line with your original asset allocation. And if you’ve got cash sitting on the sidelines, think about deploying it. As legendary investor Warren Buffett says, “Buy when there’s blood in the street.”

We’re here to help. If you would like to talk things over, give us a call at 888.86.AZZAD or email info@azzad.net. Thank you for your continued trust and investment.

Past performance cannot guarantee future results. No investment strategy can eliminate the risk of losses. Asset allocation, rebalancing and diversification are investment strategies used to help manage risk. They do not ensure a profit or protect against a loss.

Opinions expressed are those of the author or fund manager, are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Click here for Azzad Ethical Fund current top 10 holdings.

Past performance does not guarantee future results.

The Azzad Ethical Fund is non-diversified and may invest a larger percentage of its assets in fewer companies exposing it to more volatility and/or market risk than diversified funds. The Fund may not achieve its objective and/or could lose money on your investment in the Fund. Stock markets and investments in individual stocks can decline significantly in response to issuer, market, economic, political, regulatory, geographical, and other conditions. Investments in mid-cap companies can be more volatile than investments in larger companies. Investments in growth companies can be more sensitive to the company’s earnings and more volatile than the stock market in general. Because the portfolio may invest substantial amount of its asset in issuers located in a single country or in a limited number of countries, it may be more volatile that a portfolio that is more geographically diversified. See the prospectus for more details about risks.

Investments in smaller and medium sized companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a great risk of loss to principal and interest than higher rated securities.

The Azzad Wise Capital Fund is non-diversified with a high concentration of securities in the financial sector which can expose the Fund to more volatility and/or market risk than diversified funds. The Fund may not achieve its objective and/or could lose money on your investment in the Fund. The Fund mainly invests in securities issues by foreign entities which expose the Fund to country specific risks such as market, economic, political, regulatory, geographical, and other risks. The Fund intends to invest in certain instruments that may be illiquid. As a result, if the Fund receives large amount of redemptions, the Fund may be forced to sell such illiquid investments at a significant loss to be able to meet such redemption requests. See the prospectus for more details about risks.

Recent Posts

Why consolidating your investments makes financial sense

Bumpy road ahead?

Market Timing Reminder: Just Say No

Why I became a financial advisor

Weekly Market Recap – June 5, 2023

Behavioral Finance: Why investors make the decisions they do

Why I became a financial advisor

How to Boost your Retirement Savings

How to ask your employer for halal 401(K) investment options

What You Should Know About Required Minimum Distributions (RMDs)