In a speech to the United Nations General Assembly on countering violent extremism, President Barack Obama quoted Shaykh Abdullah bin Bayyah, founder of the Forum for Promoting Peace in Muslim Societies, as saying, “We must declare war on war so the outcome will be peace upon peace.” This noble sentiment is certainly worth pursuing, but how do we start to make it a reality? The answer, in part, could be found in the resurgence of Islamic finance.

Although modern expressions of Islamic finance began only in the 1970s, they employ timeless principles such as profit-and-loss-sharing that can provide an alternative to some of the more speculative and exploitative aspects of conventional finance. Combining foundational ideas with their modern applications could be part of the strategy to undermine the root causes of war by alleviating poverty in underdeveloped parts of the world.

Trade as a tool for good

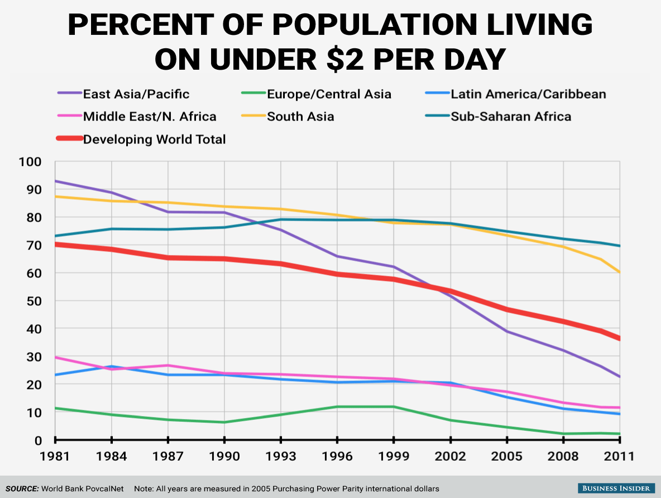

According to the World Bank, extreme poverty has fallen dramatically in emerging economies since 1981. About 70% of the developing world was living under $2 per day in that year, but this rate fell to just over 36% in 2011. The United Nations says that trade has been a primary reason for this poverty alleviation.

Trade has played a major role in the successful global effort to halve extreme poverty so far, and it can do a great deal more in the years to come. But we have to make sure that the poor feel the full benefits of trade, giving them an opportunity to improve their quality of life and to give their children opportunities for further advancement.

Ethical trade finance should be part of the solution. Up to 80% of global trade is supported by some sort of financing or credit insurance. But developing countries are still suffering from the consequences of the 2008 crisis. The supply of credit has not yet returned to normal levels, so we continue to see big financing gaps, particularly in Africa and Asia, pockets of which are vulnerable to the influence of violent extremism as a response to inequality and other social grievances.

The estimated value of unmet demand for trade finance in Africa is between $110 and $120 billion. In Asia, it is estimated at more than $1 trillion. The result is that opportunities for growth and development are often missed, depriving businesses of the fuel they need to grow and preventing societies from leveraging trade’s full power as a source of development and poverty alleviation.

Why you should care about the ITFC

One way we can respond to the problem of missed trade opportunities and related effects is through solutions offered by Islamic finance. The International Islamic Trade Finance Corporation (ITFC), a multilateral financial institution established in 2008 by the AAA-rated Islamic Development Bank (IDB), is doing just that.

As a leader in Islamic trade finance, the ITFC’s primary focus is to encourage trade among the 57 member countries of the Organization of Islamic Cooperation, many of which are those nations in Africa and Asia that have missed out on the gains of global trade since 2008. Not coincidentally, some of those nations have served as hotbeds of hostility to the current global economic order and should therefore be targeted for the promotion of peace through trade.

As a member of the IDB Group, the ITFC has unique access to governments in its member countries and it works as a facilitator to mobilize private and public resources towards achieving its objectives of fostering economic development.

The ITFC helps businesses in member countries gain better access to trade finance without exorbitant rates of interest or fraud and provides them with the necessary trade-related capacity building tools in order to help them compete successfully in the global market.

By providing favorable terms of trade to everyone from fair trade coffee cooperatives in Indonesia to groundnut farmers in the Gambia, the ITFC is taking aim at the root causes of extremism and making an impact.

Doing our part

As part of our mission to use investment capital for the promotion of a sustainable economy, Azzad Asset Management is already participating in a group of syndicated deals with the ITFC through the Azzad Wise Capital Fund, our socially responsible fixed-income mutual fund focused on global community investing. And we expect more trade finance investments to come.

I encourage you to learn more about the important work the ITFC is doing with Islamic trade finance and how you can participate as an investor in many of these worthwhile projects.

After all, it’s a win-win solution. Governments can promote domestic industry. Small- to medium-sized businesses get access to religiously sanctioned products and are therefore more likely to use them. And all parties receive a greater share of the global gains from trade.

Most important of all, let’s start to understand the economic underpinnings of social decay and religious extremism and do something about it by promoting Islamic finance solutions as a response to Shaykh bin Bayyah’s call to action. The laudable Islamic principles of partnership and risk-sharing can have an impact in communities around the world, the net result of which is sustainability, job creation, and poverty alleviation in the regions that have missed out on many of the benefits of global trade in recent decades.

By promoting Islamic finance here and abroad, we can each do our part to create a society that promotes peace through commerce.

Joshua Brockwell is the Director of Investment Communications at Azzad Asset Management. He can be contacted at joshua@azzad.net.

Opinions expressed are those of the author or fund manager, are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Click here for Azzad Ethical Fund current top 10 holdings. Click here for the Azzad Wise Capital Fund current top 10 holdings.

Past performance does not guarantee future results.

The Azzad Ethical Fund is non-diversified and may invest a larger percentage of its assets in fewer companies exposing it to more volatility and/or market risk than diversified funds. The Fund may not achieve its objective and/or could lose money on your investment in the Fund. Stock markets and investments in individual stocks can decline significantly in response to issuer, market, economic, political, regulatory, geographical, and other conditions. Investments in mid-cap companies can be more volatile than investments in larger companies. Investments in growth companies can be more sensitive to the company’s earnings and more volatile than the stock market in general. Because the portfolio may invest substantial amount of its asset in issuers located in a single country or in a limited number of countries, it may be more volatile that a portfolio that is more geographically diversified. See the prospectus for more details about risks.

Investments in smaller and medium sized companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a great risk of loss to principal and interest than higher rated securities.

The Azzad Wise Capital Fund is non-diversified with a high concentration of securities in the financial sector which can expose the Fund to more volatility and/or market risk than diversified funds. The Fund may not achieve its objective and/or could lose money on your investment in the Fund. The Fund mainly invests in securities issues by foreign entities which expose the Fund to country specific risks such as market, economic, political, regulatory, geographical, and other risks. The Fund intends to invest in certain instruments that may be illiquid. As a result, if the Fund receives large amount of redemptions, the Fund may be forced to sell such illiquid investments at a significant loss to be able to meet such redemption requests. See the prospectus for more details about risks.