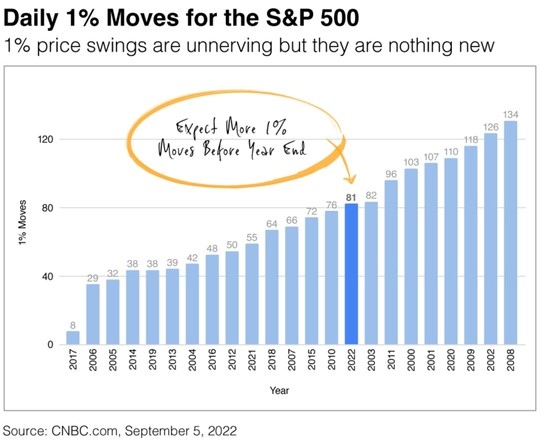

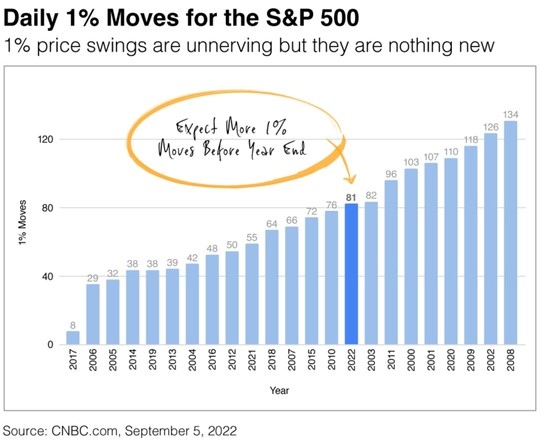

Client note on volatility and inflation

Continue Reading

© 2025 Azzad Asset Management. All Rights Reserved

You are about to leave the Azzad website and enter a third-party website. We are not responsible for and cannot guarantee the accuracy of any information on a third-party website.